AS THE 2018/19 season draws to a close the current global crop supply and demand figures are improving.

The International Grains Council (IGC) May 2019 market report increased total old crop grain production which, along with a continuing steady lift in world consumption, had lifted its current crop trade and carryover stock estimates for total grains.

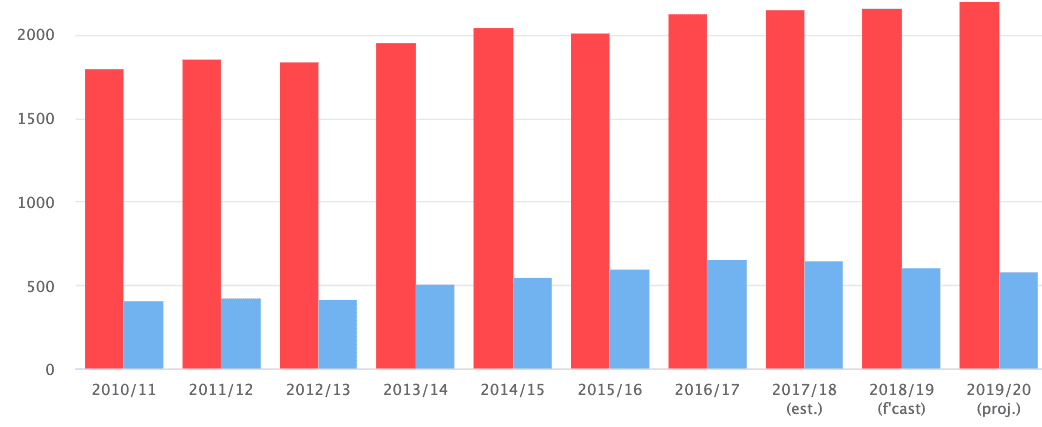

Total grains production in 2018/19, comprising wheat and all the coarse grains such as corn, barley, sorghum and oats, this month is forecast at 2138 million tonnes (Mt), 9Mt higher than the previous month.

Carryover stock at the end of 2018/19 is now forecast at 617Mt, a fall of 29Mt compared to year-end 2017/18.

World grain stock has fallen for two years in a row as rising consumption each year outpaced two years lower production.

Corn the star of old crop

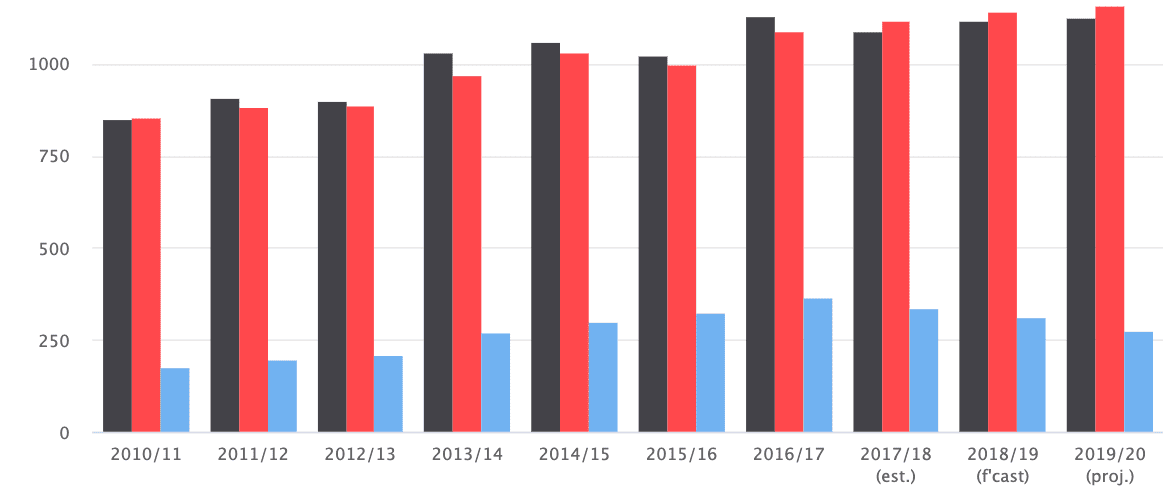

While world wheat in 2018/19 saw 29Mt lower production, the corn crop more than compensated, rising 34Mt to 1126Mt; corn trade was up 10Mt to 162Mt, consumption up 25Mt to 1144Mt and corn carryout stock lifted 19Mt to 317Mt.

Maize stock (blue) diminishing, consumption (black) and production (red) increasing. Million tonnes. Source:IGC

The improvement in world crop outcomes as the year went on was in part due to better rainfall, growing grass and crops during the northern hemisphere winter through the Middle East and sub-Saharan Africa which provided forage for livestock and increased regional production of crops.

Though world wheat stock at the end of 2018/19, at 263Mt, is down 8Mt year-on-year, it is set to return to record level at the end of 2019/20.

Records are also forecast for current and new crop rice production, 500Mt and 504Mt, and rice consumption at 499Mt in 2019/20.

2019/20 prospects bright

While it is early days yet in the 2019/20 crop calendar, IGC this month saw total grains production, at 2177Mt, slightly lower than last month though 2Mt higher than previous year. Smaller world sorghum and corn crops, including in the United States, outweighed better global prospects for wheat and barley.

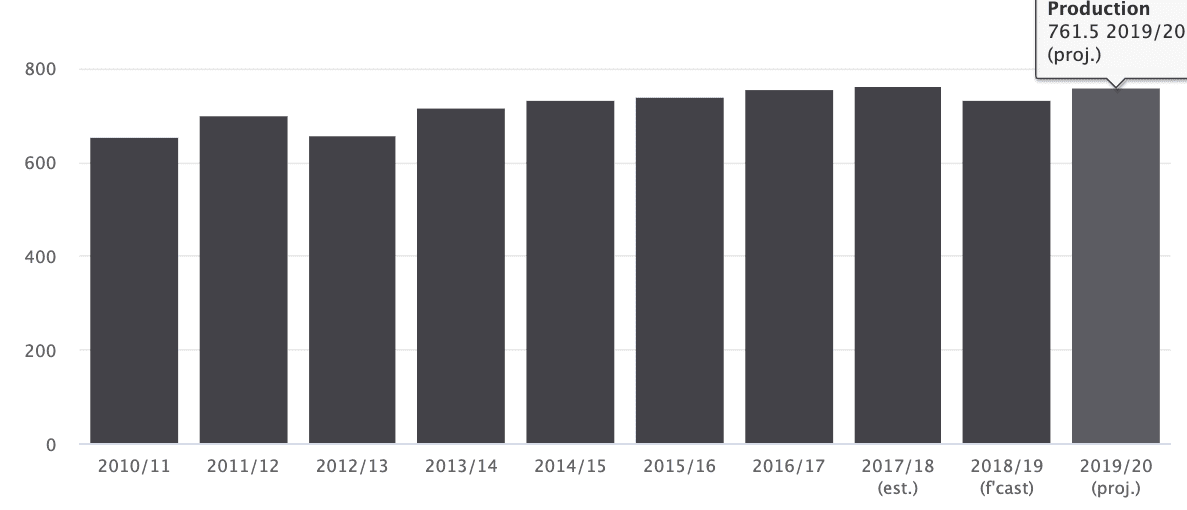

World wheat production, at 761.5Mt in 2019/20 would be slightly lower than the record 763.4Mt produced in 2017/18. Source: IGC

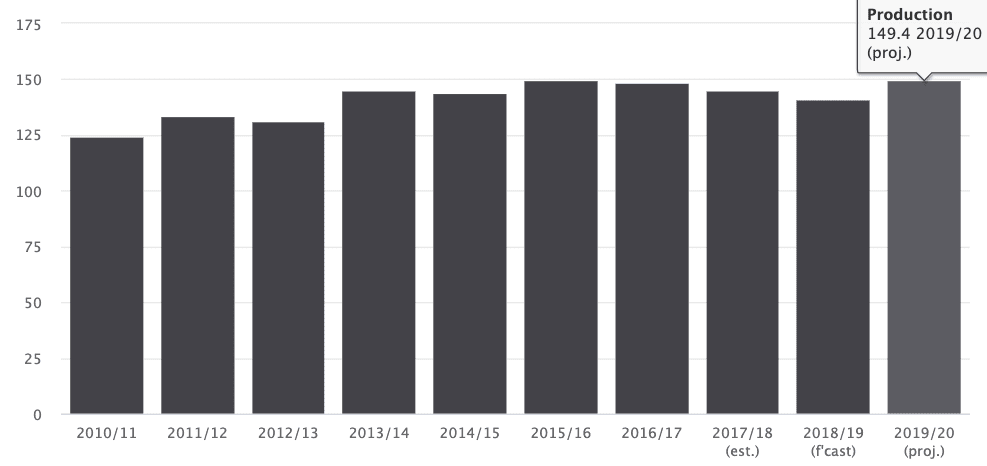

IGC forecast 2019/20 wheat production at 766Mt and barley 149Mt.

The bigger global grain crop would entirely compensate for smaller opening stocks to lift supply slightly higher year on year.

Nevertheless, with consumption growth predicted to outstrip the bigger crop, IGC envisaged the third successive annual stock contraction to a four-season low of 602Mt, entirely due to shrinking corn stock, its lowest in six years.

In contrast, after falling in the prior season wheat stock could rebound to a record level at the end of 2019/20.

World grain trade is predicted 1Mt higher year-on-year at record 369Mt, slightly exceeding the peak of two years ago on anticipated increased shipments of wheat and barley.

Source: IGC

Considering global grains and oilseeds harvests, it’s always important to be aware of the calendar. This year is going to be especially sensitive because the effects of the climate change on the harvests are up one side and down the other on both markets and the related food industry. While not a typical market driver, the U.S. Presidential election also will have widespread ag implications, primarily the future of ethanol and international trade relations. If you’re hedging risk or speculating in ag futures, be sure to incorporate the evolving U.S. political situation into your 2020 grain market outlook.