A hold on the Saga Odyssey is filled with its break-bulk cargo of cotton at the Port of Brisbane in August 2022 to mark Australia’s first volume sales to Turkiye. Photo: Mark Duffus, MD Photography

THE outlook for global cotton prices is flat to slightly bearish, according to Omnicotton senior vice president and Texas Cotton Association president Beau Stephenson.

Speaking at Cotton Australia’s Cotton Collective forum in Toowoomba this week, Mr Stephenson said the continued absence of China as a major importer, and slowing global demand, provided no upside to the global price outlook.

That currently sits in line with the world price over the past eight months of US77-86 cents per pound.

“We haven’t been able to find a story that’s been able to break us out of this range,” Mr Stephenson said.

China is currently forecast to produce 27Mb of cotton in the current year, and Mr Stephenson said the actual figure could turn out to be up to 10pc below that.

Omnicott senior VP Beau Stephenson.

“They might import more, or dip into their own reserves. “

“China still remains the biggest variable in terms of world production.”

Mr Stephenson said world beginning stocks were the fourth-highest on record, and second-highest stocks on record outside of China.

“That means there’s more cotton available to the trade in the world than there ever has been since we’ve been keeping these records, with the exception of the pandemic year.”

Mr Stephenson said that was when “demand fell off a cliff”.

“Leaning on this story of a big China resurgence…is probably on flimsy footing at this point in time.”

Last month, China announced it would issue cotton import quotas totalling 750,000t for non state-run firms, and Mr Stephenson said China’s import demand remains the big unknown.

“China’s traders have been buying big volumes in the past 3-4 months; perhaps they’re doing it ahead of future demand in China.”

Success for Australia in diversification

Australia, Brazil and the United States collectively produce around 70pc of the world’s traded cotton, and comfortable production outlooks for Australia and the US, coupled with an expected 20 percent growth in Brazilian production in its upcoming crop, also put paid to any bullish sentiment.

“Brazil is forecast to grow something like 14 million bales this year; that’s going to be an all-time record for Brazil in a country where they’ve already vocally and publicly made a commitment to become the world’s largest cotton exporter; they’re certainly putting up the results this year.”

Mr Stephenson said the quality of Australian cotton, and proximity to export markets, gave it an advantage over Brazil.

“There’s really nowhere else in the world where you can get quality …and transit times.”

He said Brazil’s distance from what have become key Australian markets like Indonesia and Vietnam factored into buyers’ equations.

“Australia represented 18pc of all cotton exports in the world this year; that’s the largest percentage of global exports that Australia has commanded in a year.

“I think the previous record was something like 13pc, and also Australia was the second-largest exporter in the world this year; it just snuck in above Brazil by about 100,000 bales.”

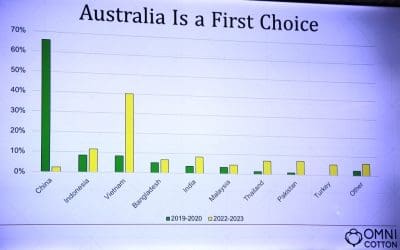

Destinations for Australian cotton for the 2019-20 and 2022-23 marketing years. Image: Omnicotton

“The Australian cotton market has had to really work hard without the traditional big buyer being available.

“What’s interesting is that two of the world’s biggest cotton consumers, Pakistan and Turkiye, have also started buying Australian cotton.

“We think this is going to have long-lasting implications.”

China in 2019-20 was the destination for around two-thirds of Australia’s cotton, and figures for 2022-23 indicate volume has fallen away to a miniscule amount.

In contrast, exports to Vietnam more than quadrupled, and sales to destinations including India, Thailand and Turkiye have surged.

Lacklustre sentiment from mills

According to USDA’s World Agricultural Supply and Demand Estimates released last month, world cotton consumption for 2022-23 (Aug-Jly) is seen at 110Mb, down from 122Mb forecast in June last year, and 116Mb in 2021-22.

USDA’s estimate for global consumption in 2023-24 estimates a bounce-back to 116Mb, as pointed to by historical data.

“We’ve never had three consecutive years of global decline.”

Mr Stephenson said finance issues for Bangladesh and Pakistan, the world’s two largest importers behind China, affected their buying, and Turkiye’s earthquake in February reduced its demand.

“The epicentre of that is where 30-40pc of all Turkiye’s textile production is.”

Mr Stephenson said demand signals were far from encouraging.

“Mill sentiment generally is very bad at the moment.

“We’ve done a lot of outreach to our customers around the world…and one thing they keep telling us is that they’re running at a very reduced capacity, something like 60-70pc of normal capacity; some are running even lower.”

“As the market has slowly crawled up to the top of this (price) range over the last week or so, we’re seeing an increasing number of sales being invoiced back to the merchants.

“Not only are we buying cotton from the producers, we’re also buying it back from sales we’ve previously made over the last six months.”

“This is not a good indicator of demand.”

In its July WASDE, USDA said 2023-24 higher global beginning stocks accounted for much of the 1.7Mb increase expected in ending stocks.

Beginning stocks are 1.1Mb higher as a 1.8Mb increase in estimated 2022-23 production spread over India, Brazil, and Australia more than offsets a 675,000-bale increase in global consumption, and a 350,000-bale decrease in Argentina’s ending stocks.

USDA last month cut its estimate for global consumption in 2023-24 by 550,000 bales to 116.45Mb based largely on a 500,000-bale reduction for China.

USDA estimates 2021-22 and 2022-23 both started with stocks of 86Mb, but will click into 2023-24 with 94Mb, with China alone estimated to have beginning stocks of 39Mb.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY