WORLD cotton consumption is estimated to have slumped 7.6 million bales, or 6.4 per cent, in the past month, according to the United States Department of Agriculture’s (USDA) April report.

The fall represents the largest monthly change in consumption recorded in the USDA database.

The unprecedented reduction is driven by the rapidly developing impacts of COVID-19 on countries around the world.

The unprecedented reduction is driven by the rapidly developing impacts of COVID-19 on countries around the world.

It represents a loss of about 3.5 weeks of global spinning or about 16pc of the expected spinning March through July based on the March USDA forecasts.

The USDA report says COVID-19-driven changes in behaviour and regulations are significantly impacting the supply chain of the cotton sector.

For example, cotton spinning in China fell by upwards of 90pc during the height of the crisis in early March.

Recent travel restrictions in India, Pakistan, and Vietnam are likely to have similar impacts on cotton supply and demand in the short-term.

While spinning and other manufacturing sectors in China have begun to recover to some extent, the decline in consumers’ global consumption of apparel is expected to limit any dramatic global recovery for spinners in this marketing year.

Across the board

Reductions in consumption this month are spread across all consuming countries of note.

In addition to physical disruption across the global supply chain from farm to retailer, global cotton end-use (i.e. world retail sales of clothing and textiles) has plummeted amidst large portions of the global population limiting activity outside their homes and/or confined by stay-at-home orders and with many “non-essential” businesses including apparel stores closed.

The two largest importers of apparel, the European Union and the United States, have seen widespread closure of shopping malls and retail stores, while three-quarters of the US population are under travel restrictions.

US unemployment is rising at an unprecedented rate, leaving less income devoted to discretionary items such as apparel.

Spending on clothing is highly correlated to changes in GDP. With expectations for unprecedented declines in global GDP for the first half of CY 2020, weak consumer demand is forecast to persist and negatively impact cotton demand.

Retailers are responding to rapid declines in consumer spending by reducing and cancelling orders for textiles and apparel worldwide.

The severity and timing of consumer “demand destruction” will likely dictate how significant cotton consumption declines in the current marketing year and how long it may persist into 2020/21.

Prices drop

Cotton prices have declined significantly in recent weeks, with the nearby ICE futures contract falling below 50 cents for the first time in over a decade.

This has pressured spinners as higher-priced cotton purchased earlier in the season arrives when current prices are now 10 to 20 cents lower.

Prices are expected to remain pressured with global consumption forecast at a six-year low, world ending stocks at their highest level in five years, and stocks outside of China 25pc above the previous record.

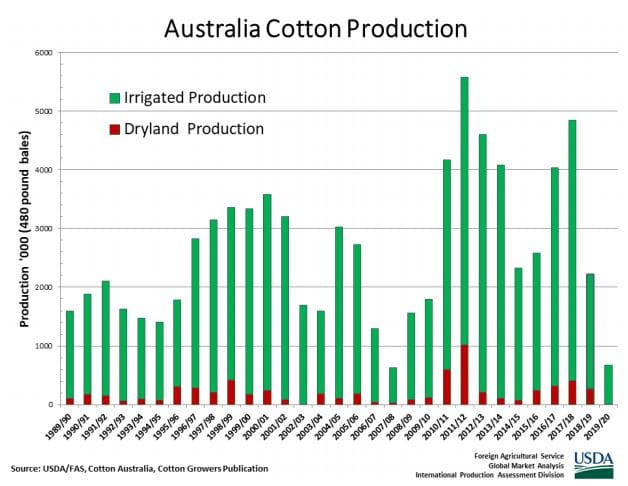

Australian production

The USDA has revised its forecast for 2019/20 Australia cotton production down by 7pc to 625,000 bales, down 50,000 bales from last month and 1.58 million, or 72pc, from last year.

The harvested area, essentially all irrigated, is estimated at 60,000 hectares, unchanged from last month, and down 84pc from last year due to below-normal rain during the first half of the growing season and a subsequent lack of soil moisture for dryland sowing operations. Additionally, irrigation water availability has been severely limited.

The average Australian cotton yield is forecast at 2.268 tonnes/hectare, 23pc above the five-year average.

Source: USDA

HAVE YOUR SAY