THE WORLD wheat market has risen in response to concerns about food security in the face of COVID-19, despite supplies being at record highs, according to the latest USDA Grain: World Markets and Trade report.

In response to the pandemic, some countries are restricting grain exports, while others have issued tenders for more purchases, with both measures fuelling stronger prices.

Consequently, prices have rallied for both wheat and rice, even though global supplies are at record levels and the share of stocks to consumption is historically high.

Ample wheat

Global wheat production is estimated at a record high in 2019/20, with major producers such as China, the European Union, India, Russia, and the United States all having more than sufficient to meet rising global demand.

A storage pad is prepared for wheat now being harvested in India’s Punjab province. Photo: CMO Punjab

Furthermore, wheat harvests in major producing countries in the northern hemisphere are only a few months away.

Wheat ending stocks are also projected at a record of 292.8 million tonnes (Mt), up from 287.1Mt seen last month.

Of that, China is estimated to hold more than half at 150.4Mt, up from 148.3Mt seen last month.

India, the world’s third-largest producer, has ending stocks estimated at 24Mt, up from 22.1Mt seen last month.

India’s figures represent seven-year highs, with stocks built following several consecutive years of bumper crops.

The top eight global wheat exporters hold about 20pc of global stocks.

Although these exporter ending stocks are projected to tighten in 2019/20, they are at sufficient levels to support forecast trade.

Global production estimates are virtually unchanged, while global consumption has fallen, mainly on reduced food, seed, and industrial use in India, as well as decreased feed and residual use in China and the EU.

Global trade is slightly lower, with reduced imports seen for Japan, Brazil, and Uzbekistan.

Higher exports for the EU are expected to offset reduced shipments from Russia.

Prices jump

All major exporter prices rose during March, underpinned by rumours of potential market scarcity.

Discussions surrounding potential export restrictions and stockpiling by importers supported prices.

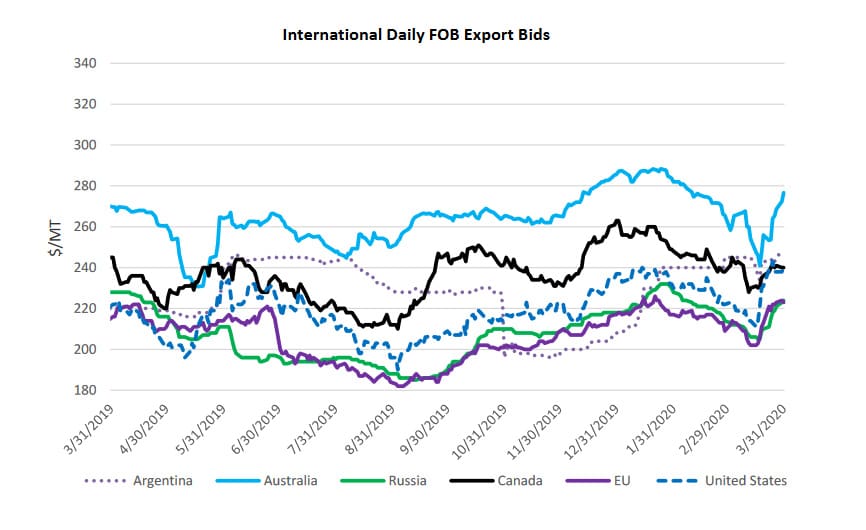

Figure 1: Comparative free-on-board wheat prices in US dollars per tonne for: Argentina 12pc protein up-river; Australia-average of APW values in Fremantle, Newcastle and Port Adelaide; Russia Black Sea milling; EU-France grade 1, Rouen; US-HRW 11.5pc protein Gulf; Canada CWRS 13.5pc protein Vancouver. Source: International Grains Council

Russia’s prices jumped based on tightening domestic availability and expectations of upcoming export restrictions, but price gains were capped by a weakening ruble.

EU prices spiked even further with strong demand continuing.

US Hard Red Winter (HRW) wheat prices skyrocketed, diminishing its competitiveness with Russia and the EU.

Canada’s prices increased only slightly to reach parity with HRW after holding a premium for several months.

Canada’s transportation bottlenecks are starting to lessen, which could encourage stronger pace of shipments in subsequent months.

Argentina and Australia saw their prices rise even further with seasonally tightening supplies.

| Argentina | Australia | Russia | EU | US | Canada | |

| January | 240 | 282 | 228 | 217 | 230 | 248 |

| February | 245 | 266 | 214 | 209 | 222 | $238 |

| March | $248 | $277 | $224 | $223 | $240 | $240 |

Table 1: Month-ending prices in US dollars per tonne for major wheat exporters. Source: USDA

Russia planting at speed

According to the Russian Ministry of Agriculture, spring wheat planting has begun and is proceeding at a quicker pace than last season.

Winter wheat will not reach full vegetative growth for another one to two months; timely rainfall during this period will be critical for winter wheat yield.

While rainfall in February helped alleviate any lingering autumn drought issues, short term dryness has returned to southern Russia.

Warmer-than-normal spring conditions have accelerated growth, causing winter wheat to emerge from dormancy several weeks earlier than average.

Early spring conditions are generally favourable and adequate soil moisture is available to the early emerging crops.

The overall planting for total winter grains including wheat as reported by the Russian Ministry of Agriculture in the beginning of December was at a record 18.2 million hectares (Mha), almost 1Mha higher than last year.

Source: USDA

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY