The day ahead

Weather – Clear skies in Australia should see Vic, southern NSW and southern SA get back into it. Globally, western Ukraine looks wet, France and Germany get a much needed break from rain and Argy/Brazil are set to get more rainfall. It is bearish row crops, neutral wheat.

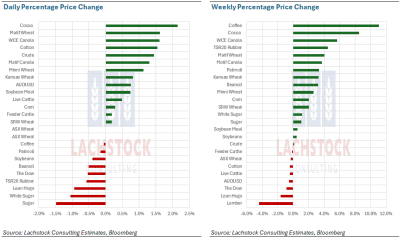

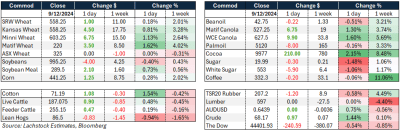

Markets – The pre-WASDE session finished slightly firmer, Russian cash was unchanged at US$230-235. AUD crawled above 0.6400 with an RBA rate announcement today expected to be unchanged at 4.35pc and no market-moving news.

Markets – The pre-WASDE session finished slightly firmer, Russian cash was unchanged at US$230-235. AUD crawled above 0.6400 with an RBA rate announcement today expected to be unchanged at 4.35pc and no market-moving news.

Australian day ahead – It is all about southern quality as headers fire up again. Early anecdotes would suggest quality may have held up better than expected. Aussie markets can be quiet before an offshore report so I don’t expect much change.

Offshore

The USDA report will have some key data points. Corn exports and ethanol use should both be bumped up, as should Russian wheat exports. However, the main data point the market will be interested in will be Chinese demand, across all grains.

China’s top leaders have adopted their most assertive tone on economic stimulus in years. Futures indicate the Hang Seng Index is set to surge by over 3pc, with Tokyo expected to see a modest uptick and Sydney likely to open with minimal change. Meanwhile, the Nasdaq Golden Dragon China Index, which tracks leading Chinese stocks listed in the US, soared 8.5pc—its sharpest rise since late September. Industrial metals and oil also gained momentum as Beijing emphasized the priority of boosting domestic demand. Chinese 10-year bond yields declined for the fourth consecutive session on Monday. The Politburo announced plans to adopt a “moderately loose” monetary policy in 2025, signalling a significant policy shift not seen since 2011. Leaders also committed to more aggressive fiscal measures, efforts to stabilize property and stock markets, and a strong push to stimulate consumption. Attention now turns to the upcoming annual Central Economic Work Conference, a key closed-door event set for later this week.

Winnipeg canola firmed overnight, capping a weekly gain of 6 percent. MATIF wheat outperformed US wheat classes.

Russian wheat exports are projected to reach 3.4–3.5 million tonnes (Mt) in December, down from 4.6 million tonnes in November, according to the analytical centre at Rusagrotrans. Exports could drop further to 2.5–3 million tonnes in January, it told Interfax. Despite higher export prices at ports and declining domestic prices in southern regions, a sharp increase in export duties—rising to 4,871.50 rubles per tonne (₽ /t) as of December 11 (an increase of 1,175₽ /t from the previous week)—has severely impacted profitability, resulting in losses of about 1,500₽ /t. It said this development could lead to a significant reduction in Russia’s wheat exports and a notable increase in export quotas at ports. Export offer prices for Russian wheat (12.5pc protein) with December delivery rose US$2 over the week to $228/t fob. During the same period, French wheat prices climbed $5 to $240/t, German wheat rose $4 to $254/t, and American wheat increased $4 to $429/t.

Australia

Canola bids in Western Australia began the week at around A$855 FIS, with GM bids $110 lower. Wheat was bid at $387, and barley at $329, with the malt premium now $10, down from a $30 premium last month.

In the east of the country, canola bids worked higher, being bid slightly below $800 to begin the week, while cereal bids were largely unchanged. Faba bean bids have worked lower over the last week, down $20-$40 from recent highs, with some of the shorts seemingly having been covered.

Delivered Murray Bridge wheat bids are around $355, which is close to a $30 premium to local ASW site bids.

HAVE YOUR SAY