The day ahead

Weather – We are entering the time of year where weather takes a back seat. With generally clear skies over Australia it is hard to see the weather having much influence.

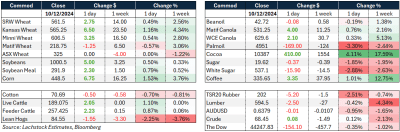

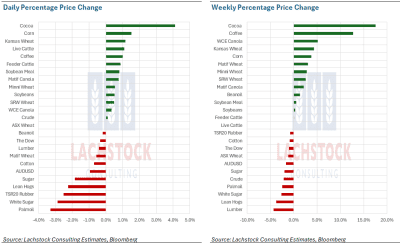

Markets – Firm across the board post the latest USDA – more on that in a minute.

Markets – Firm across the board post the latest USDA – more on that in a minute.

Australian day ahead – Unchanged. thats my guess. Things firmer offshore but clear skies should create some pressure. AUD back below the magic 0.6400 helps the exporters, albeit only just.

Offshore

Tuesday’s WASDE report brought much-needed optimism for grain bulls, sparking rallies in corn, soybeans, and wheat. The most notable action centred around the corn balance sheets. Domestic corn exports have reached their strongest start in five years, prompting USDA to raise its annual estimates by 150 million bushels. Global corn ending stocks also took a significant hit, dropping by 7.7Mt to 296.44Mt, despite a modest rise in global production. Wheat followed closely behind, with notable changes to global balance sheets, including substantial production cuts in the EU and export restrictions from Russia, which boosted the U.S. wheat outlook. Meanwhile, the soybean balance sheets remained unchanged.

Corn – The USDA’s decision to increase domestic corn export projections by 150 million bushels, bringing the total to 2.745 billion bushels, was well justified. Additionally, the USDA raised its estimate for domestic corn use in ethanol production by 50 million bushels. These adjustments led to a 200-million-bushel reduction in domestic ending stocks, now pegged at 1.738 billion bushels. This sharp decline in ending stocks was the day’s biggest surprise, falling below the average trade estimate range. On the global front, balance sheet revisions highlighted the U.S. position in the market. Global ending stocks were reduced by 7.7Mt to 296.4Mt, primarily due to production cuts in the EU and Mexico, coupled with increased import demand from Bangladesh, the EU, Mexico, and Iran. Notably, Chinese corn imports were reduced by 2Mt to 14Mt, reflecting China’s recent minimal corn import activity.

Wheat – Adjustments to global wheat balance sheets provided support for US domestic wheat figures. U.S. wheat exports were raised by 25 million bushels, reaching 850 million bushels, which led to a corresponding reduction in domestic ending stocks by 20 million bushels, now at 795 million bushels. On the global stage, EU wheat production was reduced by 1.3Mt to 121.3Mt, and global trade projections were lowered by 1Mt to 213.7Mt due to Russia’s newly implemented export quota. Despite this, global ending stocks increased slightly by 0.3Mt, bringing the total to 257.9Mt—still the tightest levels since the 2015/16 season. Wheat markets reflected the mixed news, with March Chicago wheat closing marginally higher at US$5.61 ½, while March KC wheat reacted more strongly, finishing 6 ½ cents higher at $5.65 ¼.

Australia

The east of Australia saw canola bids slightly higher, being bid around A$800, with cereal bids largely unchanged again. Faba bids have fallen across the board this week, losing between $50-$80.

The delivered Geelong bid for Jan+ dropped around $75 over the last week to be bid at $600. Reports suggest shorts are being covered and potentially yields in Victoria are better than the “disaster” that was initially portrayed.

Western Australia CBH receivals have now exceeded 16Mt for 24/25, with wheat making up half of the received tonnage, barley around 4.5Mt, and canola 2.7Mt. Across the border in South Australia, Viterra receivals are approaching 2.5Mt, with some estimates suggesting the state is around 70% complete which unsurprisingly will be the lowest receivals in recent times.

HAVE YOUR SAY