Weather: Rain is still sitting in the back end of the forecast in Argy – heaps of it. Models are aligned, the only negative is presently how hot it is, and the forecast is also hot. Russia is groundhog day with little moisture, temperatures are really cold and there is not much snow cover. The US has another cold snap in front of it – should be fine given it comes with a bunch of snow.

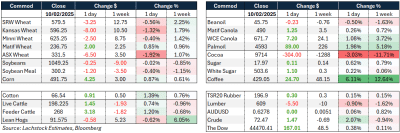

Markets: The bleed. Grain markets eased with little in the way of new info. USDA report will come out tonight – they seem to come around quickly – so there was probably some position-squaring adding to the sell pressure. The Australian dollar is at a technical cross roads and Donald Trump’s tariff talk heat seems to be dissipating, which may add a bid.

Australian Day ahead: Market in Australia today will be interesting given we are seeing more offshore pricing inquiry, not being knocked over, but we are pricing. With China still going very slow, if we are going to hit export targets, the basket of other countries needs to do some more heavy lifting.

Offshore

The Australian dollar was slightly higher overnight, 62.8c, despite the announcement of a 25 percent tariff on Australian steel and aluminium and tariffs on Chinese goods.

Gold price has spiked to an all-time high of US$2900 per ounce amid ongoing trade and tariff uncertainty.

The week ending Feb 4 marked fund managers’ seventh consecutive week as net CBOT corn buyers. This duration of net buying has only been observed once (September 2022) within the last four years albeit with notably fewer contracts.

Central Argentina is expected to receive some good rain over the next week which will improve the soybean crop prospect and do some good for corn, particularly later planted.

Brazil’s 2024/25 soybean crop is expected to reach 174.88 million tonnes (Mt), agribusiness consultancy Safras & Mercado said on Friday, raising its estimate from a previous 173.71Mt.

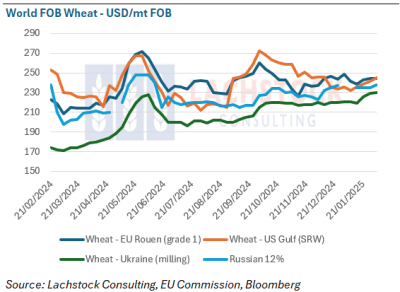

Russian Institute for Agricultural Market Studies, IKAR, reduced its 2024-25 wheat export forecast for Russia by 500,000Mt to 43Mt, citing low stocks and weak margins. It also lowered its 2025 wheat production estimate to 82Mt from the previous 84Mt in its baseline scenario, warning that expected freezing temperatures, combined with insufficient snow cover, could damage crops.

Brazil 2024/25 soybean harvest was 15pc completed as of Feb. 6 according to Brazilian agricultural consultancy Ag Rural. Compares with 9pc a week earlier and 23pc in the same period last year.

Australia

WA canola bids were softer to begin the week, down around $5 to $850 FIS, while wheat remained steady at around $377, and barley was slightly stronger at $345.

Eastern Australian canola was down around $10, bid at $765, while wheat remained steady at $349 and barley at $315. New crop canola bids were around $735, with wheat at $350.

GM canola delivered into container homes is still trading at around a $60 premium to the track market, with bids around $700–$710 delivered to Geelong/Melbourne or $700 into SA delivered homes.

Record red meat exports from Australia for January saw 24kt lamb, the second-largest January volume on record, and 81kt beef, a new January record. Goatmeat and mutton exports also reached record highs at 4kt and 20kt, respectively.

HAVE YOUR SAY