Weather: Insane weather ranges globally – most talked about has been the ranges in the US. Colby KS went from minus 18°C a few weeks ago to 26°C. The 2-week forecast now has 25°C and no rain. Roztov in Russia got to 16°C and will be above 15°C for the next week – however, there is some rain on the forecast which is desperately needed.

Markets: not sure if the cat is dead but the market is bouncing. Outside markets are fixated on what will become of the US economy once President Trump has done what he wants to do. The Dow was off 2pc last night as the R word got thrown around. Goldman Sachs adjusted its outlook for the US economy but Donald is unrelenting – suggesting that, rather than a recession, it’s a period of transition.

Australian Day ahead: more of the same really. AUD under 0.6300 helps the bid side but the engulfing wider market speculation makes the market risk adverse if nothing else.

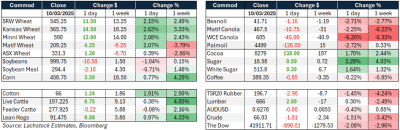

Offshore

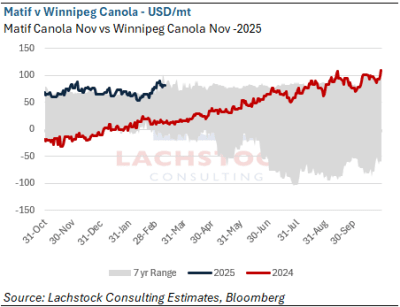

The premium of rapeseed price in Europe over canola Winnipg has been greater than $US50/t since mid 2024. Source: Bloomberg via Lachstock

Market uncertainty reigns. The policy shift of President Trump is quickly becoming a binary outcome. He is either going to fix the US and get domestic manufacturing humming OR this will be an unmitigated disaster – it is going to be one or the other. It is hard to trade commodities in isolation so fundamentals seem to be taking a back seat. There are growing concerns about weather in the US Southern Plain.

Canola is a minefield. Friday – China announced tariffs on Canadian canola oil and meal and peas. The timing is crucial given the Canadian canola growers are making planting decisions. The headline shock took WCE canola down hard but, the only known is that there will more twists and turns. Most of Canadian oil heads to the US which, while there is no 25pc tariff is still okay. Meal is more impactful because around 40pc of Canadian meal heads to China so the Canadian crusher has taken a punch in the nose. Finding homes for this meal will be a challenge and has some impacts on the Aussie export program. It is hard to see Canada having access to both China and the US – it feels like it will be one or the other – however, with Donald Trump destabilising the global economy it is difficult to have confidence in any direction.

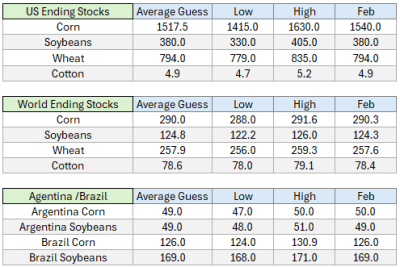

USDA report is here again! Will USDA bake in some of the tariff work that is taking place. The stocks report at the end of the month tends to carry more weight but we will see how proactive the USDA will be.

Brazil 2024/25 soy harvest 61pc done as of March 6: AgRural pace compares with 50pc a week earlier and 55pc in the same period last year, according to an emailed report from consulting firm AgRural. Winter corn seeding in the southcentral Brazil was 92pc completed, compared to 80pc in the previous week and 93pc a year ago, where also summer corn harvest reached 54pc, versus 46pc a week earlier and 57pc in the same period last year.

Australia

Local report will return tomorrow.

Here the trade guesses prior to tomorrow’s reporting have US corn stock possibly down a little over 1 percent and South American summer crop guesses unchanged, bar Argentine corn production down 2 percent. Source: Lachstock

HAVE YOUR SAY