The day ahead

Weather – Light showers fell across the Black Sea over the last few days but not market moving. Storms continue to hammer South East Asia although palmoil has come off the highs. Australian skies still are clear which should see most of the country get through harvest – much of the southern belt will be in record time.

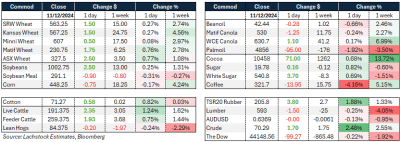

Markets – Slightly firmer after a higher start. Wheat was largely treading water awaiting tomorrow’s Russian exporter meeting. As you can imagine, everyone has an opinion as to what the outcome will be – how Russia allocates the quota the main question. CONAB out tomorrow also which kept corn and beans quiet.

Markets – Slightly firmer after a higher start. Wheat was largely treading water awaiting tomorrow’s Russian exporter meeting. As you can imagine, everyone has an opinion as to what the outcome will be – how Russia allocates the quota the main question. CONAB out tomorrow also which kept corn and beans quiet.

Australian day ahead – AUD alone should keep some interest. Pulses are all over the shop – clearly a few shorts have found some cover in beans which has been bleeding lower the past few days. Wheat is trying to work out how much damage has been done to the Vic crop.

Offshore

On the eve of the Russian exporters meeting SovEcon has suggested that Dec exports will be between 3.3 and 3.5Mt, down from 4.1Mt in November. Exporters will be very keen to hear how the govt plans to manage the quota, especially with reports that export margins have turned negative due to the increasing tax – which has almost doubled in the past few months. Things get challenging this time of year despite the quota or tax. Winter approaches, and grain needs to be pulled from further away – while this is an annual event, it does feel like the global balance sheet is not factoring any real delays. USDA still has a 47Mt export number in for Russia don’t forget.

India is trying to limit the amount of wheat traders and endusers can hold, to stop hoarding in what is an extremely tight balance sheet.

China remains the balancing item for global wheat S&Ds. The potential shortfall in Russian exports could easily be taken off China imports so the sensitivity to China demand for Q1 and Q2 becomes massive. Current estimates for Australian wheat exports to China range from 600kt to 1Mt – well short of the 3+Mt most have in their sheets.

CONAB will release its latest estimates of Brazilian production with the market looking for 121Mt of corn and 169Mt of soybeans.

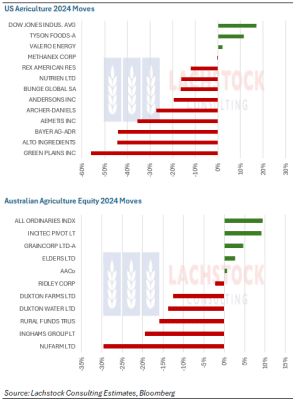

The escalating risk of a renewed trade war poses significant challenges for American farmers already struggling to reclaim their position as leading exporters of staples like corn and wheat. Brazil has capitalised on the earlier US-China trade tensions, gaining market share and planting more soybeans, which has reduced demand for US crops. This year, US corn and soy prices hit their lowest levels since 2020, further straining growers. Analysts predict that a return to Trump’s trade policies could bring tariffs and retaliatory measures from China, which would likely depress grain prices further. While a resolution may eventually arise, China is expected to maintain a reduced appetite for US imports. Agriculture remains particularly vulnerable to retaliatory moves due to the relative ease of switching suppliers, leaving American farmers exposed in a volatile global market.

Australia

In the west, canola is stronger, with conventional bids around A$885 and GM bids at $745. Wheat bids were slightly softer, with APW1 bid around $375. Barley bids were off $1-2, with bids around $321.

Canola worked higher in the east yesterday now bid slightly over $800, with GM at $698. Canola bids have gained around $50 in the last 2 weeks to now be only $10-15 from the high-water mark this season. Wheat bids were slightly stronger, with APW bid around $355. Barley bids were around $306.

Chickpea bids delivered Brisbane are now around $930, up nearly $100 from recent lows but still $150 away from season-high prices.

Aussie barley is close to starting to price into Saudi Arabia, aided by global barley FOB values ticking higher over the past 1-2 weeks and with the lower AUD.

HAVE YOUR SAY