Weather: Limited rainfall forecast for Russia, which, once again, doesn’t seem to matter right now. Early days but worth keeping an eye on French rainfall which is starting to drop behind averages with some higher than normal temps thrown in.

Markets: WASDE with a sprinkling of Donald Trump. More on the USDA changes shortly but a slightly heavier US wheat balance sheet didn’t help things. Mr Trump reckons the US economy isn’t going into recession but will actually go “Boom”. WCE canola continues to take it in the neck post the China tariff news.

Australian Day ahead: AUD is stuck in the mud and uncertainty reigns so values still probably defensive. Canola should be lower today.

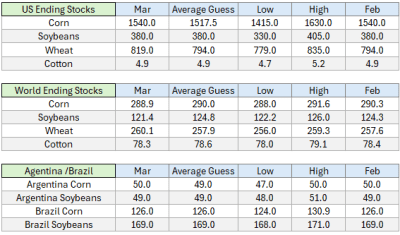

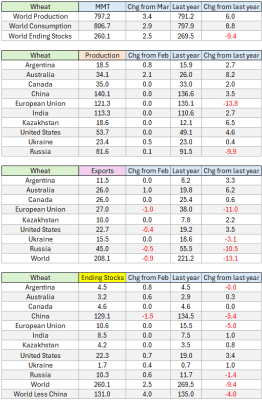

USDA March WASDE boosted US and world wheat ending stocks 3 percent and 1pc respectively, reduced world soybean stock 2pc, and left unchanged its South American summer crop production forecasts. Source: Lachstock

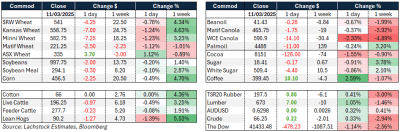

Offshore

- USDA WASDE. World wheat ending stocks went up 2.5 million tonnes (Mt), driven by increases in Aussie production, up 2.1Mt, Argy 0.8Mt and Ukraine up 0.5Mt. US wheat ending stocks went up as well – from 794mbu to 819mbu with exports being pulled back. Soybean global ending stocks shrank a little, from 124.3Mt to 121.4Mt with increased world crush. All in all, it was not a crazy report. Worth noting that the USDA mentioned tariffs but said it would ignore them until they actually are implemented.

- President Trump initially threatened to double tariffs on Canadian steel and aluminium to 50 percent but later settled on the previously announced 25pc after Ontario abandoned plans for an electricity surcharge on US exports. While Trump dismissed concerns about a tariff-induced recession, he warned executives to expect more tariffs and possible rate hikes. The escalating trade tensions have unsettled investors and corporate leaders, with economists cautioning about potential consumer price increases, harm to US exporters, and economic slowdown, as markets have already dropped about 10pc from their peaks.

- Russia/Ukraine War: President Trump is pressuring Russia to accept a ceasefire agreement negotiated between Ukrainian President Volodymyr Zelenskiy’s advisers and American officials in Saudi Arabia. The deal, which calls for a 30-day halt in the conflict, depends on Russian President Vladimir Putin’s approval. After eight hours of discussions, Ukraine agreed to the terms in exchange for the Trump administration lifting its freeze on military aid and intelligence support for Kyiv.

- AUD/USD: The Australian dollar remained stable after the White House confirmed that Australia would not be exempt from US steel and aluminium tariffs. Meanwhile, bond markets eased following President Trump’s dismissal of recession concerns, despite Wall Street’s unease over his trade policies. Mr Trump expressed optimism about the economy, stating he expects the country to “boom” and downplayed market fluctuations as a normal part of rebuilding the nation.

HAVE YOUR SAY