The day ahead

Weather – Broken record. get used to it as we enter the Northern Hemisphere winter. We will get some fun and games with South American row crops but, today at least, nothing market moving. nothing to see here, carry on.

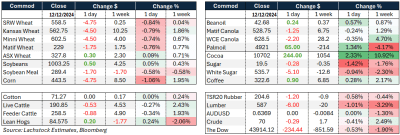

Markets – Sharply boring. Wheat rallied yesterday on ideas that the Russians would give the bulls something to eat – unfortunately it was a non-event. Buy the rumour, sell the fact. AUD still on its knees even with a strong employment print.

Markets – Sharply boring. Wheat rallied yesterday on ideas that the Russians would give the bulls something to eat – unfortunately it was a non-event. Buy the rumour, sell the fact. AUD still on its knees even with a strong employment print.

Australian day ahead – Probably bleeds a little today into the weekend. It already feels like the Christmas week somehow. unchanged to slightly lower across the board is my prediction.

Offshore

The Rosario Board of Trade increased the Argentinian wheat crop forecast from 18.8Mt to 19.3Mt. (USDA 17.5Mt)

Saudi is seeking 595kt wheat for Feb to April delivery. Aussie should feature.

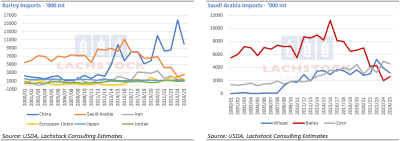

LHS: China barley imports have risen while Saudi Arabia fallen.

RHS: In Suadi Arabia wheat and corn continue to rise at the expense of barley. Click expand

Australia’s unemployment rate fell unexpectedly to 3.9pc in November, down from 4.1pc in October, defying economists’ expectations. This marked continued resilience in the labour market despite elevated interest rates. Employment increased by 35,600, driven entirely by full-time jobs. Following the data release, the Australian dollar strengthened, and yields on three-year government bonds rose, leading traders to scale back expectations of a February interest rate cut.

China plans to increase public borrowing and spending in 2025, shifting its focus toward boosting domestic consumption to address economic challenges and counteract potential impacts of US tariffs on exports. At the Central Economic Work Conference, led by President Xi Jinping, officials announced plans to raise the fiscal deficit target and prioritise stimulating domestic demand and consumption—marking only the second time in a decade this has been a top focus. The government also pledged to strengthen the social safety net, including healthcare and pensions, to address concerns related to the ageing population and household savings.

Palm oil prices declined further after Malaysia’s official data revealed a smaller-than-expected drop in stockpiles, driven by a sharp rise in imports. Reserves fell 2.6pc in November to 1.84Mt, the lowest since July, but higher than the 1.80Mt forecasted in a Bloomberg survey. The Malaysian Palm Oil Board reported a nearly 15pc decline in exports and a 35pc increase in imports during the same period.

The EPA is investigating imports of used cooking oil (UCO) to ensure compliance with biofuel tax incentives and the Renewable Fuel Standard (RFS) program. Since July 2023, the agency has been auditing renewable fuel producers’ supply chains to verify the authenticity of UCO feedstocks used in biofuel production. The investigation is ongoing, and details remain undisclosed. If fraud is uncovered, it could disqualify some biofuels from tax incentives and RFS credits. There are growing calls for greater transparency in the UCO supply chain and assurances that imported UCO is not blended with palm oil, particularly given deforestation concerns linked to European programs.

Australia

Canola bids in the west were down around A$25, settling at approximately $855–$860 FIS yesterday. Cereal bids were largely unchanged. In the east of the country, canola bids held steady around $800. Wheat bids firmed slightly, with offers around $350. Barley bids were around $310, with a $10–$15 spread to BAR2 as post-rain downgrades start to roll in.

Australian canola exports to Pakistan have reached 280kt in line-ups already for the first 3–4 months of the 24/25 season, surpassing the 5-year average of 250kt. Most of this canola is likely GM seed.

Some good harvesting weather looks likely over the next week, with less than 5mm of rain forecast for most of NSW, Vic, and SA, accompanied by warmer condition.

HAVE YOUR SAY