The day ahead

Weather – Rainfall bleeding out of the forecast for Argy with basically nothing over the weekend. Max temps getting to 39°C according to the Euro model which, given balance sheet changes to the balance sheet by the USDA, becomes a massive concern.

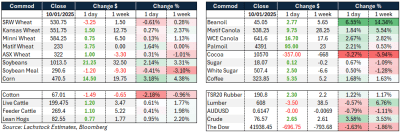

Markets – All about the WASDE, unless of course you are wheat, in which case you don’t care. more on that shortly.

Markets – All about the WASDE, unless of course you are wheat, in which case you don’t care. more on that shortly.

Australian day ahead – AUD 0.6147! enough said…. well, maybe there are other things. While Chicago wheat ignored the balance sheet changes to corn and beans I don’t think that stays that way. Corn is now massively exposed to South America and wheat is already being fed. A wheat rally built around corn tightness is a slow burn but, structurally, tends to last. We will see. Firm today in Aust across the board.

Offshore

Offshore

- Trump watch – Canadian Prime Minister Trudeau has grown a backbone as he gets set to leave office. In an interview with US cable news channel MSNBC political analyst Jen Psaki, he said that while Canada is not looking for a trade war with the US it would retaliate if the US were to impose tariffs.

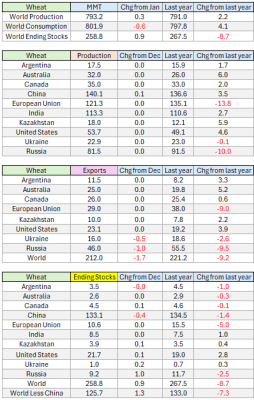

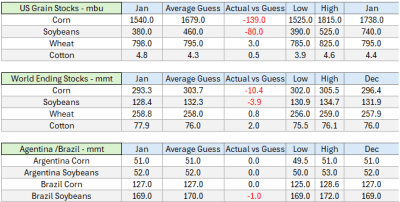

- USDA WASDE Click on the tables to expand. Corn… all about corn. The USDA cut US yield by 3.8bu/ac and while there was some swings and roundabouts with increased harvested acres and lower exports, the US ending stocks now sit at 1.54bbu vs the average trade guess at 1.679bbu – historically a decent miss.

Beans were also tightened through lower production which, ultimately put ending stocks under the magical 400mbu mark. At 380mbu, stocks-to-use ratio is sub 10 percent.

Wheat – yawn. Most would have assumed that, given the tightening in corn, wheat would have caught a bid but, no. Global stocks came in pretty much smack on the pre-report guess. There was little global production change, but exports went down, led by Russia down 1 million tonnes, which pushed up ending stocks.

Australia

Canola ended the week well supported with WA bids around $880 FIS; WA wheat was steady around $372, with barley around $322.

In the eastern states, canola ended the week above $800, bid around $805. Wheat was unchanged, with APW at $345, and barley around $305.

2024 was the largest year for red meat exports from Australia in history, with the US the largest market for beef, lamb, and goat meat. Record cattle-on-feed numbers translated to strong turn-off figures, with grain-fed beef breaking records at 375,195 tonnes exported. This trend is likely to continue with current wheat and barley prices and a strong cattle market, providing good margins for feedlotters.

Pulse bids continue to be well-supported by the weak AUD. Delivered Geelong/Melbourne faba beans are bid around $610 and lentils at $930–$940.

HAVE YOUR SAY