Weather: Spot fires are everywhere at the moment with warm and really windy through the Southern Plains in the US, and continued dryness in the Black Sea. Dryness for safrinha corn is becoming a conversation starter. Rio Grande do Sul soybean yields are around 30 percent lower year on year given dryness and heat. For me it is all about the Black Sea which does have some moisture forecast but not nearly enough.

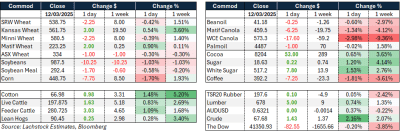

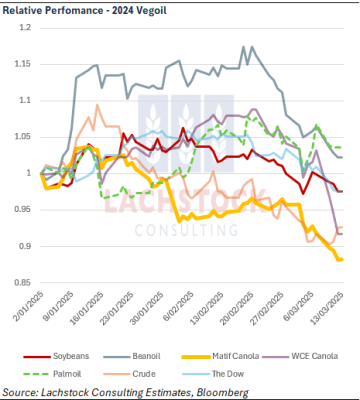

Markets: A mixed result in the grains but WCE canola continues to get slapped, off almost 10pc over the week. Positioning in all financial markets is becoming extreme and Ags are not immune. We have hit a record short for this time of year in Matif wheat, Chicago wheat and just off the record for Minni and Kansas. The jack-in-the-box just took another turn.

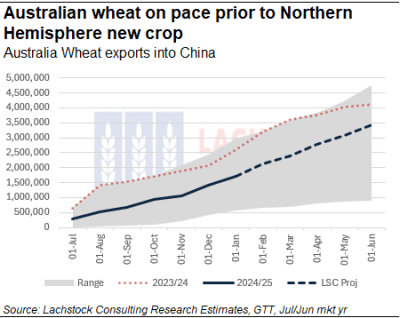

Australian Day ahead: AUD is slightly firmer but Aussie grains have held in pretty well all things considered. WA is set to get some rain and we hold on to hope that Vic and SA get a drink – albeit a small one. Canola will be slightly lower, grains should hold in there.

Offshore

Positioning vs fundamentals: Matif wheat is short – flat out short. Algeria bought somewhere between 450kt and 650kt which puts a massive dent in its ownership before we get a look at new crop. Spec positioning in isolation can sometimes be wildly misleading as you can only see one side of the trade. Massive out of the money shorts may have a deeper in the money long against them, however, when the spec positioning is completely at odds with the fundamentals it is always a head scratcher. Ag futures markets historically do not have the liquidity of other commodity markets, so, if there is a catalyst, then positioning matters. Having said that, I was impressed with Matif Dec-24 wheat allowing the massive short to get out without fanfare.

Positioning vs fundamentals: Matif wheat is short – flat out short. Algeria bought somewhere between 450kt and 650kt which puts a massive dent in its ownership before we get a look at new crop. Spec positioning in isolation can sometimes be wildly misleading as you can only see one side of the trade. Massive out of the money shorts may have a deeper in the money long against them, however, when the spec positioning is completely at odds with the fundamentals it is always a head scratcher. Ag futures markets historically do not have the liquidity of other commodity markets, so, if there is a catalyst, then positioning matters. Having said that, I was impressed with Matif Dec-24 wheat allowing the massive short to get out without fanfare.

Donald Trump: Every day there is a something new – the 25pc steel and aluminium. EU retaliated with US$26 billion worth of tariffs aimed at US goods. Even at home, the flow on impacts of Donald II, the squeal, are being felt hard. Australian researchers who collaborate with US federal agencies have been asked to declare links to China, and asked if they comply with Donald Trump’s two-gender policy, sparking fears their funding could be cut if they fall foul of his anti-DEI, America-First agenda.

Russia/Ukraine War: A year or two ago, any sniff of a supply disruption in the Black Sea would have triggered at least 24 hours of buying. Not now. A Russian missile hit the port of Odesa with at least four Syrian nationals killed. A wheat vessel, destined for Algeria was hit with Ukrainian officials highlighting the impact on global food security.

AUD/USD: The Australian dollar remained stable after the White House confirmed that Australia would not be exempt from US steel and aluminium tariffs. Bond markets eased following President Trump’s dismissal of recession concerns, despite Wall Street’s unease over his trade policies. Mr Trump expressed optimism about the economy, stating he expects the country to “boom” and downplayed market fluctuations as a normal part of rebuilding the nation.

HAVE YOUR SAY