Weather: Central and Southern Plains wheat dormant in good condition; snow may offset early-week cold damage. Recent rain benefits SRW wheat in the Delta and Midwest. Eastern Black Sea wheat remains poor. Spain, Italy, and North Africa see favourable rain, northwestern Europe too wet, southeastern Europe too dry. China’s wheat mostly favourable.

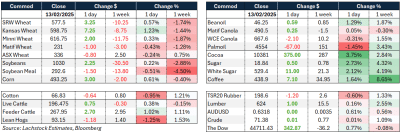

Markets: Corn and wheat were supported by impressive weekly sales data. SAM corn is supported by improving weather but there is still some dryness which is helping drive futures higher. President Trump vowing to end the Russian Ukraine conflict is expected to be bullish for wheat on the back of a strengthen Ruble.

Australian Day ahead: Steady. Wheat and corn stronger overnight likely to be offset by a rise in the Aussie dollar, expect strong feed bid and cheap container rates to continue to grind bids across all wheat grades through the east slowly higher.

Offshore

USDA reported corn sales of 2 million tonnes (Mt) across both marketing years, exceeding the 1.7Mt analyst forecast. Wheat sales also surpassed expectations, while soybean sales were significantly weaker than projected.

Corn exports for old crop were just shy of 65 million bu. for the week up 12pc from the previous week and up 20pc for the 4-week average.

France’s ag ministry cut 2024-25 non-EU wheat export forecasts by 100,000t to 3.4Mt, the lowest since 1996-97 and down 67pc from 2023-24. Intra-EU exports rose by 100,000 MT to 6.24Mt, just 50,000t lower than last year.

Soybean meal prices in China have jumped over 25pc early this year, hitting a 1-year high due to tight supply and Brazil’s delayed harvest. Longer customs wait times, import limits, and rising US trade tensions add pressure. China now relies more on Brazil, reducing dependence on US beans.

Conab raised Brazil’s corn production forecast by 2.46Mt to 122Mt, while the Rosario Grain Exchange cut Argentina’s estimate by 2Mt to 46.6Mt.

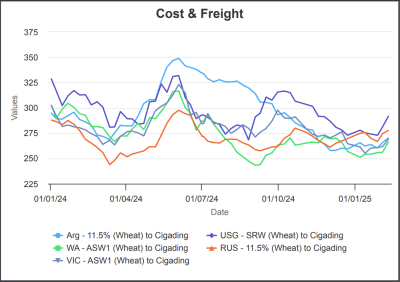

Saudi Arabia’s state grain importer has announced a fresh wheat tender for 595,000t 12.5pc milling wheat for May-July shipment. Ten consignments of 12.5pc protein hard wheat are sought with shipments of around 60,000t to the ports of Jeddah, Dammam and Yanbu.

Australia

WA canola bids were unchanged with current crop around A$850 and new crop $805. Wheat was bid $377 for current crop and new crop $392; barley bids were around $340 with new crop $310.

Through the east of the country canola was bid $765 with new crop around $740. Wheat was bid $346 and barley stronger around $318.

Rainfall over the next week is widespread through the east and west of the country with 15-25mm forecast for most WA cropping regions. Eastern regions through NSW and Vic have 25-50mm forecast for most parts.

Early reports suggesting there will be an increase in faba bean hectares planted ahead of the 25/26 season on the back of strong prices this season, which still see delivered Geelong bids around $640 prompt.

New season delivered to crush canola bids are now posted with delivered Footscray bid around $770 and Newcastle $780.

HAVE YOUR SAY