Weather: US Southern Plains has a significant storm system forecast to move into the region on Friday, bringing strong winds that could cause damage. However, substantial precipitation is more likely in areas to the north and east, leaving the Southern Plains drier than desired. This lack of moisture, combined with above-normal temperatures and strong winds, may reduce soil moisture critical for greening winter wheat and forages. Still pretty warm in India and no rain for Russia of substance.

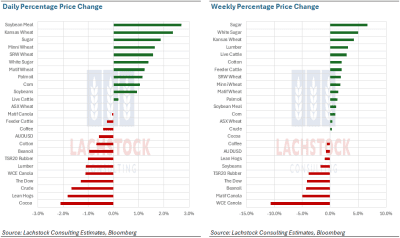

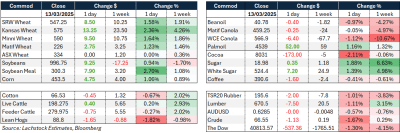

Markets: Been a while since we had futures up and AUD down. Markets fighting all kinds of inputs at the moment. Fundamental concerns around production, tariff-a-palooza, massive positioning. The fact we close within a percent of the previous day baffles me. Some stability starting to show in vegoil, albeit post a savage pull back.

Australian Day ahead: With the systems set to push south it feels like the old crop market may find some legs today. Southern ex farm barley markets have firmed this week which shows the containment feeding demand. Firm today.

Offshore

Offshore

- Positioning vs fundamentals. We mentioned this yesterday – but it feels like the short is becoming more uncomfortable by the day. Asset re-allocation from equities to something like Ags is probably a discussion as well with all that is going on in the world.

- Donald. If you are in the US and love your French Red, you have woken to a disaster – Donald talking about slapping a 200% tariff on EU booze. He is also trying to end the birthright citizenship. It does feel like the Russia/Ukraine ceasefire could get some legs – Putin actually thanked Donald for his help.

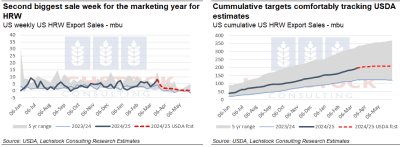

- US Export Sales were very solid – proof again that, when markets break we find demand. White wheat and Hard Red Winter did the majority of the business.

- Corn market strength: Led by wheat, strong sales at 967.3kt and rumours of China purchasing 10-15 cargoes of Brazilian corn.

- Soybean and meal strength: SK gained 10.25c, SMK up $6.90, and Brazilian premiums rallied.

- Argentine oilseeds union strike: Disrupting exports and supporting meal prices.

- Rosario cutting Argentine crop estimates: Soybeans cut 1 million tonnes (Mt) to 46.5Mt, corn 1.5 Mt to 44.5Mt – tightening supply.

- China’s record soybean imports: Expected at 31.3Mt in Q2 due to supply tightness.

- Ukraine’s record soybean exports: 2.35Mt in first half of 2024/25 season, highlighting global demand.

HAVE YOUR SAY