The day ahead

Weather – File copy paste. Weather non threatening aside from Australia. More rain forecast in the US winter wheat belt, wet again in France, nothing really in the Black Sea aside from Ukraine’s western belt which should see some rain over the next 2 weeks.

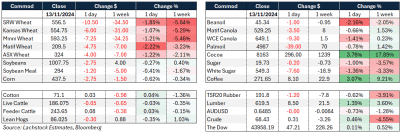

Markets – Higher USD, lower commodity futures. AUD back under 0.6500 last night which is a little odd given US CPI was inline with expectations and the market got more comfortable with a US rate cut.

Markets – Higher USD, lower commodity futures. AUD back under 0.6500 last night which is a little odd given US CPI was inline with expectations and the market got more comfortable with a US rate cut.

Australian day ahead – The harvest grind continues. End users maybe a little twitchy about the rainfall forecast through the better part of NSW. A lower AUD doesn’t hurt.

Offshore

US inflation held steady in October, interrupting its previous uneven decline and limiting the Federal Reserve’s flexibility in aiming for a soft landing. The core consumer price index, which excludes food and energy costs, climbed by 0.3 percent for the third consecutive month. Over the past three months, it has risen at an annualised rate of 3.6pc, the fastest pace since April, according to Bloomberg’s analysis.

US inflation held steady in October, interrupting its previous uneven decline and limiting the Federal Reserve’s flexibility in aiming for a soft landing. The core consumer price index, which excludes food and energy costs, climbed by 0.3 percent for the third consecutive month. Over the past three months, it has risen at an annualised rate of 3.6pc, the fastest pace since April, according to Bloomberg’s analysis.

Donald Trump’s influence over markets is impressive given he won’t have the keys until January. Seems every day he appoints a new person, most of which are long time Trump hardliners. Of interest to agricultural markets was the appointment of Tulsi Gabbard to Director of National Intelligence. Tulsi has previously taken some heat over her comments seemingly taking Vladimir Putin’s side in the Russia/Ukraine war so her approach to both Ukraine funding and Russian negotiations could be significant for the flow of wheat from both countries. This comes after Trump appointed Lee Zeldin to head of the EPA. Zeldin previously has favoured watering down the current RFS.

Pressure on CBOT wheat came from reports indicating that US rainfall is benefiting an otherwise struggling winter wheat crop. The latest USDA crop progress report showed a 3-point increase in winter wheat rated as good or excellent, raising the total to 44pc. Aside from this, other factors weighing on wheat prices have remained consistent this week.

In the “market doesn’t care” bucket, Russia Rusagrotrans said Russian winter wheat seedings would only be 15.4 million hectares, the lowest since 2018-19. According to USDA, Russian all wheat production in 2018/19 was 71.6Mt vs the 5-year average of 84.5Mt.

I don’t get the short in Matif wheat. I have to remind myself that you can only see one leg of a trade when viewing CFTC data – the fund position that is 166k short wheat is a tight balance sheet could be long anything against it – bitcoin, who knows. But the pace of Russian exports means the chocolate wheel will eventually land on France to do some heavy lifting – quality and quantity make this task seem supportive of price if nothing else.

Australia

In the west, canola values were off yesterday, losing around A$35 to be bid $865 with GM at $755. Wheat bids were steady around $365, and barley at $325. Canola bids were stronger in the east, only sliding $3 to be bid $817 with GM at $751. Cereals were largely unchanged.

Malt barley receivals in Western Australia are trailing behind where they normally would be, with the percentage of barley harvested making malt running at 12pc below the 20pc average of the last 4 years. In comparison, South Australia is 3pc above the average of 25pc, surprising given the seasonal conditions.

Delivered Darling Downs markets continue to strengthen, with barley bids around $323 and wheat at $340. This is due to low grower selling and heightened freight rates, with chickpeas demanding a premium to get to port before the tariff deadline.

HAVE YOUR SAY