The day ahead

Weather – is 10mm enough for Argy? The Euro model has 10-20mm while the GFS is basically nothing. The crop still appears to be living off the amazing start to Dec with the NDVI smack on average. However, with the max temps pushing historical highs, more rainfall is needed.

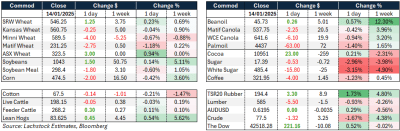

Markets – Quiet day really. Softs were belted but grains and oilseeds were pretty flat. AUD back to within sight of 0.6200 but, with CPI out in the US tonight, FX will be waiting.

Markets – Quiet day really. Softs were belted but grains and oilseeds were pretty flat. AUD back to within sight of 0.6200 but, with CPI out in the US tonight, FX will be waiting.

Australian day ahead – sharply boring. Tomljanovic, Gibson, Thompson, Duckworth, Vukic and Kokkinakis all on court today – probably the most excitement you will see as cash markets will be flat.

Offshore

Trump watch – I am on record saying Trump will not impose the 25 percent tariff on Canadian goods, however, the Canadian oil sector does not share this view. Alberta premier Danielle Smith sat with Mr Trump in Florida, returning with a warning that there was no reason to believe oil would be excluded from the tariffs.

It was somewhat unexpected that the US Producer Price Index (PPI) showed things were slowing a little. Some key Federal Reserve preferred inflation measure components, such as personal consumption expenditures gauge, were mixed.

USDA predicts China soy import drop in 2024-25. Source: USDA data published in Bloomberg. Click expand view.

Egypt’s move to change its tender process is making tracking the biggest global buyer of wheat more difficult. Reduced transparency in the world market is fuelling some concerns that things are not as balanced as they may seem. Russia still dominates Egypt’s purchases, accounting for over 4 million tonnes compared with second biggest supplier, Romania, at 780kt.

Jordan bought 60kt wheat at tender at price US$267.60/t cnf

US agricultural land owned by foreigners increased in 2023 according to the USDA. Canada dominates the 45.9 million acres owned by offshore entities.

China seems to be trying to get in front of Trump’s return, buying 198kt beans yesterday and similar amount the day prior.

Israel and Hamas have agreed in principle to a ceasefire, according to a CBS report.

Australia

In the west of the country, canola bids were off slightly yesterday, bid $880 FIS. WA wheat bids enjoyed some modest gains, up $2 to be bid around $376, with 2025/26 APW MG pricing around $397 yesterday. Barley bids were unchanged, around $322 FIS.

Canola bids were slightly higher in the east, around $822. Eastern Australian cereal bids were largely unchanged, with wheat around $345 and barley $310. 2025/26 pricing in the east yesterday had canola around $735 and wheat $338.

Australian cereals are the cheapest origin grain into all Asian destinations and most of the Middle East, as seen in yesterday’s CNF grids. The next 4-6 weeks will be telling as to whether these current competitive prices, supported by the AUD, will translate into more export business.

The current wheat export pace out of SA and Vic will need to slow, or more grain will need to flow from SNSW, with 360kt due to be exported from SA in January out of a 1.9 million tonnes (Mt) export program, and 42 percent of Victoria’s 2024/25 2.5Mt program completed.

HAVE YOUR SAY