The day ahead

Weather – Rain falling in the wrong areas – Russia missed again but the next 15 days should see some average falls – temps above normal. Probably the key risk from a weather perspective is Australia. The GFS model has serious rain for the northern part of the WA belt and for a chunk of Qld.

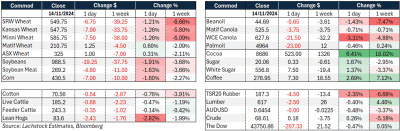

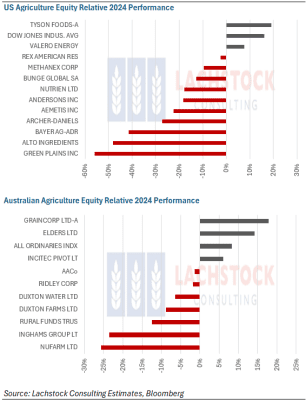

Markets – Veg oils run seems to be done. Donald Trumps appointment of Lee Zeldin to head of the EPA certainly has the market rattled. Additionally, the impact of the Fed telling everyone to pump their brakes a little and they are not taking the sword to rates attracted the sellers back to commodities.

Markets – Veg oils run seems to be done. Donald Trumps appointment of Lee Zeldin to head of the EPA certainly has the market rattled. Additionally, the impact of the Fed telling everyone to pump their brakes a little and they are not taking the sword to rates attracted the sellers back to commodities.

Australian day ahead – The AUD is saving value in Australia. The latest sound bite from the Fed should keep the AUD on the back foot. The trade and domestic consumer will have one eye on the weather given the slow pace of grower marketing, not sure they would enjoy an extended rain delay. Softer across the board today but will little passion.

Offshore

The soy complex led the veg oil market lower overnight. Donald Trump is busy – and his appointment of Lee Zeldin to the EPA was taken as bearish across the board. The market is trying to get in front of a potential flattening of the mandates and repricing the fact that anything more than E10 is off the table.

The soy complex led the veg oil market lower overnight. Donald Trump is busy – and his appointment of Lee Zeldin to the EPA was taken as bearish across the board. The market is trying to get in front of a potential flattening of the mandates and repricing the fact that anything more than E10 is off the table.

Black Sea market analyst SovEcon increased its forecast of Russia’s 2025 wheat production to 81.6Mt from 80.1Mt and, somewhat at odds with recorded rainfall, increased the winter wheat production number. It cut corn production to 11.5Mt from 12.2Mt. In respect of 2024 crop, it tickled down 2024 wheat production to 81.4Mt.

US growers, residing mainly in the red states, and for the most part Trump supporters, must be scratching their heads a little. Since the election wheat price has lost just over 7.5 percent, driven in part by the strong USD. Yes, there has been some good rain in the US over this period but some of the appointments he has made appear to be bearish to agriculture. The lobby power of the US farmer and the bio-fuel sector cannot be underestimated and it feels like the market is jumping to the worst-case scenario. We will be dealing with this uncertainty until Donald Trump gets the keys to the Whitehouse.

The function of the market is to move product from where it is produced to where it is needed. It would appear that wheat is doing that a little too efficiently. If USDA is to be believed, the global balance sheet has not been this tight since 12/13 and, with only small adjustments to their production, since 07/08. The record pace of Russian wheat exports creates an interesting back drop when you consider Russia has only have so much to give. When it reaches the end of their marketing program, logically the French exporter gets the first call. At the moment, if you are looking purely at Matif futures, French values are trading under Russian fob and the spec is record short. Much has been written about this in wires almost daily, but the structural anomaly remains. At the same time, the US interior basis markets are pricing wheat deep into the feed channel, so the world is intent on tightening these balances even more.

Australia

Canola had a second consecutive down day yesterday in the west—hard to believe given recent weeks. Bids fell $8 to $852, with GM at $752 FIS. Barley bids gained slightly to reach $326 as export business continues in the west. In the east, canola bids were down $4 to $816, with GM at $755. Barley bids remained firm around $312, with some spot demand from east coast end users providing a better option over harvest.

Rainfall models continue to build and align, with 25-50mm forecast over the next 8 days in WA and NSW.

Chickpea bids have now found support around $850 for Jan+ delivered Brisbane, indicating competitiveness in markets outside of India at this level, given the upcoming tariffs.

HAVE YOUR SAY