The day ahead

Weather – Rain heading for the Black Sea reminds us that its all about spring. Plant use is pretty low at the moment and it is all about post dormancy rainfall but this will not hurt.

Markets – markets gave up on Friday – wheat mainly. Markets now focused on the demand side of the equation, China specifically.

Markets – markets gave up on Friday – wheat mainly. Markets now focused on the demand side of the equation, China specifically.

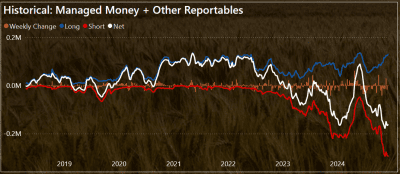

Running the what-ifs given how sensitive the balance sheets are to any variation. Post the close the markets got the CFTC report which, once again showed a market very long corn and very, very short wheat, especially when you add in Matif as well.

Australian day ahead – Depends if the third day gets going in the Test. Harvest will probably be at a standstill today given the extreme fire danger right across the east coast. Feels like the local market will get some direction from what ever the offshore market does – not that it really has any relevance, in the absence of other data.

Offshore

Egypt has struck a deal with the UAE helping to fund wheat purchases. The US$500m deal will be equally spread over a 5-year period.

GIWA increased its wheat estimate at the end of last week. The industry group lifted the estimate from 10.33Mt to 10.83Mt. Barley went from 4.52Mt to 5.09Mt, and canola increased from 2.59Mt to 2.83Mt.

China’s regulators have pledged to stabilise the housing and equity markets while implementing more effective fiscal policies. Key measures include boosting demand in the property market, controlling land supply, enhancing oversight of trading activities, and strengthening margin and derivatives supervision. The Ministry of Finance plans to adopt sustained fiscal policies, increase local government special bond issuance, and expand investment areas. These commitments follow the Central Economic Work Conference, where officials, including President Xi Jinping, emphasised raising the fiscal deficit target and prioritising increased domestic consumption and demand—marking a rare focus on stimulating consumer activity.

Australia

Canola bids in the west ended last week around A$855, with a $120 spread to GM. Barley bids remained largely unchanged for the week.

In the east of the country, canola bids were off slightly, down $3-5, to $797. Cereal bids ended the week unchanged.

Delivered Darling Downs markets have remained largely steady over the last month, with barley bid around $318 and wheat at $336.

Planet malting barley has been strongly bid over the last week, with delivered Melbourne bids now around $370 for Jan+.

HAVE YOUR SAY