The day ahead

Weather – Rain then harvest delays in the southern growing belt of Australia quickly followed by extreme fire danger harvest bans. A big chunk of Vic will be off the tools today with the heat moving through NSW as well. Globally, more of the same – nothing market moving.

Markets – Wheat tried to trade higher with the confirmation that Russia is in rationing mode but couldn’t hold onto early strength. Matif did however, testament to the assumption that the world will need their wheat and their futures contract is super short.

Markets – Wheat tried to trade higher with the confirmation that Russia is in rationing mode but couldn’t hold onto early strength. Matif did however, testament to the assumption that the world will need their wheat and their futures contract is super short.

Australian day ahead – the Christmas vacuum is just around the corner. Some of the delivered homes are looking for spot coverage with the liquidity clock ticking. On the export side, the fact we did not do any of the Saudi business may take the wind out of the sails but we should be in the box seat for buyers in East Africa, if and when they come. With the AUD still sub 0.6400 we should be unchanged.

Offshore

The recent Saudi tender was thought to be filled by the EU, Romania, Ukraine and Argentina but Australia, according to our calcs, was around US$7 off doing the business. Russia might have squeezed one or two cargos in there but, given they will be under the quota system then, they just do not have a lot to give. Makes sense that Matif outperformed both US exchanges and Russian cash given they are now in the box seat to get the phone calls once Russia is done.

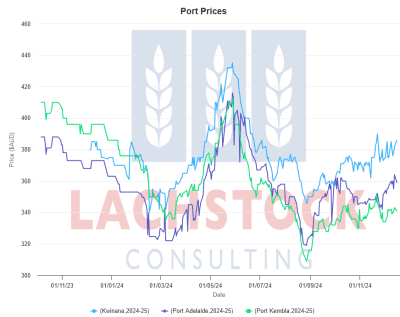

Kwinana (light blue line) APW1 wheat port bid premiums over Adelaide and Kembla have risen into the Australian new season.

President-elect Trump has signalled that President Zelenskyy will need to make a deal to force the end of the war. The US press saw this as an indication that Mr Trump will push for parts of the Ukraine to become Russian territory although he fell short of saying that.

Something is different in fund positioning. Historically, there has been a correlation between the fund positioning in wheat, corn and soybeans. Currently, this has broken down with the specs extremely long corn. If you include Matif wheat in the discussion, the funds are excessively short wheat against their bets in the corn pit. While the market is increasingly focused on the lack of China engagement, corn is tight without them.

US equities closed mostly higher on Monday as traders prepared for key interest rate decisions from major central banks this week. The S&P 500 rose 0.4pc, and the Nasdaq 100 surged 1.5pc to a record high, with Broadcom and Tesla leading the gains. The 10-year Treasury yield held steady at 4.40pc, while Bitcoin reached a new all-time high. Optimism in the US market was fuelled by expectations of a quarter-point rate cut by the Federal Reserve on Wednesday, which could further boost stock performance. This contrasts with losses in Asia and Europe, driven by weaker-than-expected retail data from China.

China retail sales came in at 3pc year on year vs the pre-report survey of 5pc. The market sees this as a clear indication the latest stimulus talk was just that, talk.

Australia

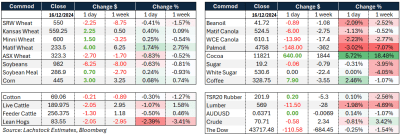

Canola bids started the week working higher to be bid around A$880 in Western Australia, with the spread to GM at $140, representing the largest spread over the last 2 years. Wheat bids were up $3 to be bid at $380, while barley moved down by $3 to be bid at $322.

In the east of the country, canola was well bid to begin the week, moving $7 higher with bids around $803. Cereal bids were largely unchanged to begin the week.

The next week looks hot and dry for most regions where harvest is still ongoing, which should help ensure most areas are finished by Christmas this year. Unfortunately, the same can’t be said for the Gabba with another stop/start day on the cards and a draw looking likely.

Up-country end-user homes in South Australia continue to represent a $20-$40 premium to local depots, with wheat into Murray Bridge and Wasleys bid around $360 and barley into the Mid North at $320, as consumers work to shore up supply.

HAVE YOUR SAY