The day ahead

Weather – Argy on the improve. Some convergence between the EU and GFS outlook with rainfall in the next few days showing more confidence. Heat has also come off a little.

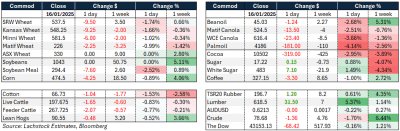

Markets – Ag commodities fell almost across the board ahead of Donald Trump’s big day. Canola led the charge while the AUD maintained its stoic indifference.

Markets – Ag commodities fell almost across the board ahead of Donald Trump’s big day. Canola led the charge while the AUD maintained its stoic indifference.

Australian day ahead – AUD finally above 0.6200 but not really with any conviction. This is not an opinion piece but I can make an argument for a higher AUD over the next few weeks. USD risk premium gets reduced with the ceasefire and some of the Trump fear bleeds out – but markets will be volatile for sure.

Offshore

Trump watch – the world holding its collective breath to see “what next”. The next week will be interesting as he has pledged to get busy. Senate grilling of potential staff members makes compelling viewing, but it looks like Trump will get his picks.

Australia’s unemployment rate edged up to 4.0pc in December, marking a 0.1 percentage point increase but remaining within the narrow range of 3.9–4.2pc over the past 10 months. The underutilisation rate held steady at 10.0pc, with November and December recording the lowest levels since September 2023. While the labour market remains robust, the sharper-than-anticipated slowdown in wage growth during 2024, coupled with softer inflation projections for Q4, suggests that an unemployment rate near or slightly below 4pc may align with maintaining underlying inflation within the target range. Additionally, our preferred labour market tightness indicator (FTE-pop) remains consistent with inflation eventually settling within the RBA’s 2–3pc target band.

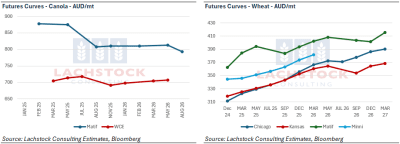

Canola is still wondering. The interim rules on biofuel feedstocks released on Wednesday did not include canola which leaves a question mark over demand. The uncertainty combined with general vegoil weakness gave the sellers all the incentive they needed.

Hey… demand… you there? Wheat on paper is compelling, tightness not seen since 2007/08 dominates the more aggressive fundamental traders outlook – yet no one has told global buyers. They can buy what they need when they want. The fact the northern hemisphere winter crop still has a big question mark over it does not matter until the thaw. Oddly, the Russian crop has been in and out of freezing which normally would have added some buying support – which has been the case to some extent in the Russian FOB market but not in the wider wheat market.

Australia

WA canola yesterday was bid $10-$15 lower to around $860 FIS. WA wheat was bid a touch softer at $375 across most PZs. Barley was bid stronger at $330.

In the east of the country, canola bids were off around $3 to $815. Wheat was a little firmer, with APW1 around $345, and barley was unchanged at $305.

To begin the year, domestic homes continue to show the best appetite for feed wheat and barley, with the upcountry bids pricing at or above delivered port export bids.

Conventional canola continues to be well bid by domestic crushers, with delivered Melbourne bids around $840 this week.

Australian barley export bid looks to be supported by recent lifts in Dalian corn in China, with a strong cattle feedlot sector putting some stability under local bids. It shapes up as a potentially supportive time for barley on the export front.

HAVE YOUR SAY