Weather: Some pretty crazy weather over the weekend throughout the wheat growing areas of the US.

Kansas: A severe dust storm reduced visibility to nearly zero, causing a multi-vehicle pileup on Interstate 70 near the Kansas-Colorado state line, resulting in eight fatalities. Such dust storms can lead to soil erosion, potentially affecting the topsoil quality essential for wheat growth.

Oklahoma: The state faced similar dust storm conditions, contributing to hazardous driving situations and fatalities. While the immediate impact on wheat crops is uncertain, the combination of high winds and dry conditions could stress the plants.

Texas: The Texas Panhandle experienced high winds, with gusts up to 80 mph, overturning semi-trucks and creating blinding dust conditions near Amarillo. These conditions can lead to increased evaporation rates and soil moisture loss, potentially stressing wheat crops

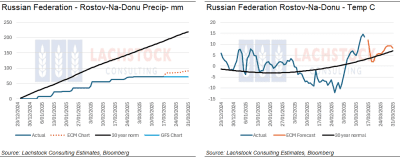

Rostov-on-Don precipitation remains low and temperatures variable. Source: Bloomberg via Lachstock. Click expand.

Rostov Oblast: one of the biggest wheat growing areas in Russia experienced record high temps for this time of year with little to no rainfall on the horizon.

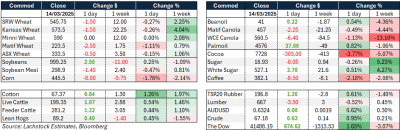

Markets: Markets were pretty happy to see the weekend arrive – Friday’s wheat market was slightly lower and the AUD was up but I feel like the conditions over the weekend should see markets catch a bid when we open up. Veg oil is still all about Donald Trump which is as random as ever.

Australian Day ahead: Rainfall was enough to prove it can rain but not enough to really do anything. Markets will look to offshore for direction and i think weather deserves some risk premium. Firm today.

Offshore

Stratégie Grains has slightly reduced its soft wheat production forecast for the 25/26 EU season from 127.7 million tonnes (Mt) to 127.5Mt (this compares to 113.5Mt projected for the current season).

French soft wheat conditions scores remained unchanged over the past week, data from AgriMer showed that 74pc of the soft wheat was in good/excellent condition as of 10 March. The crop has stabilised somewhat over the past month.

IKAR have reduced its 24/25 Russian wheat export forecast to 41Mt, down from 42.5Mt.

Stats Canada have indicated more acres of wheat would be planted in Canada this year than expected. At 27. 5 million acres this is up over 700,000 acres from last year.

China imposed 100pc tariffs on Canadian yellow peas which will provide support to local prices. The newly announced Chinese tariffs affect more than US$2.6 billion worth of Canadian agricultural product.

Australia

WA canola bids ended the week at A$785/t, with GM bids at $665 for the current crop. New crop bids were $787 and $705. Wheat bids were around $372, with barley continuing to be well supported at $356.

Canola in the east of the country was bid at $755, with GM bids around $630 for the current crop. New crop bids were $735 for conventional and $600 for GM. Wheat was bid at $345, with barley at $323.

The AUD recovered to close just above 0.63 on Friday night.

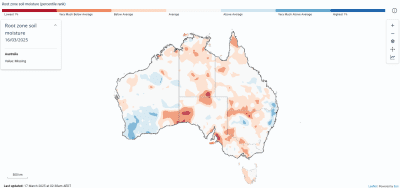

It will come as no surprise that root zone soil moisture is well below average through large parts of SA, Vic, and SNSW, with low rainfall and continuing hot temperatures. Large parts of WA’s wheat belt saw some good falls late last week, giving growers confidence as we close in on the start of seeding.

Root zone soil moisture map yesterday has arable WA above average. Eastern Australian dryness is testing the mettle. Source: Bureau of Meteorology via Lachstock. Click expand.

HAVE YOUR SAY