The day ahead

Weather – No point talking for the sake of talking – nothing to see here.

Markets – All about the AUD – a Fed rate cut was significant but the idea that there will not be as many cuts next year was a big deal. AUD and NZL both got smoked.

Markets – All about the AUD – a Fed rate cut was significant but the idea that there will not be as many cuts next year was a big deal. AUD and NZL both got smoked.

Australian day ahead – AUD provides support. Yes Chicago was lower but Russian cash was quoted up slightly and, for the moment at least, thats what we care about. Veg oil was hit but, once again, the AUD should stem the bleeding.

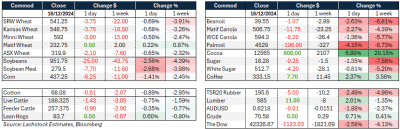

Offshore

It is all about the AUD. FOMC cut by 25bp BUT signalled fewer cuts in 2025. The AUD took this as bad news and was sharply lower. US housing starts in November fell by 1.8% month-over-month to an annualised rate of 1.29 million. Single-family home starts increased by 6.4%, while new multi-family construction dropped by over 24%. The rise in single-family starts was largely driven by a rebound in the south, likely supported by recovery efforts following hurricanes Milton and Beryl. In contrast, housing starts declined in the Northeast, West, and Midwest. Meanwhile, building permits rose by 6.1% month-over-month, reaching an annualised rate of 1.51 million in November.

The dislocation between US futures and the rest of the world continues. Russian cash is grinding higher, albeit slowly. US futures however are stuck in the mud. the reality that the US is now feeding wheat and corn is extremely well supported won’t matter until it does. We are in for a busy 2025. Donald will get the keys just before we start dealing with the break in northern hemisphere winter which will mark the tightest part of the old crop balance sheet. But that doesn’t matter today…. it will… just not today.

Malaysia hopes its palm oil industry will be fully compliant with the European Union’s anti-deforestation policy before a newly agreed deadline, its commodities minister said on Wednesday. Without turning this into an editorial piece, I’m baffled that Australian canola growers are being rejected from ISCC compliance for things like spraying next to a puddle when Malaysian palmoil is getting a tick.

US President-elect Donald Trump is set to initiate changes aimed at boosting domestic oil and gas production immediately after his January 20 inauguration. “President Trump will begin work on day one, within seconds of stepping into the Oval Office,” Karoline Leavitt, a spokeswoman for the Trump-Vance transition team, told Fox News on Tuesday. She indicated this would include executive orders to “drill, baby, drill” and accelerate permits for drilling and fracking across the country, with the goal of lowering the cost of living. Leavitt’s remarks provide a preview of the administrative actions Trump may launch on his first day as the 47th US president. These actions could involve policy changes implemented by federal agencies over the coming months and years. On the campaign trail, Trump expressed similar objectives, pledging to “unleash domestic energy production like never before.” He promised to eliminate delays in federal drilling permits and leases, open vast public land resources for energy development, and cut through regulatory “red tape” that has stalled oil and natural gas projects.

Australia

Canola values in the east were lower yesterday, bid around $785 with GM bids at $680. Wheat bids were lower, with APW around $350, and barley bids were largely unchanged, around $310.

In the west of the country, canola bids were off around $10, to around $840. Wheat was down $5, with APW at $365–$370, while barley worked slightly lower to be bid at $318.

Chickpea bids delivered Brisbane continue to maintain levels around $900. Delivered wheat markets into Geelong/Melbourne have been trading around $370 for H2 and $335–$340 for SFW for Jan+.

HAVE YOUR SAY