Weather: The next 15 days look set to remain dry through the HRW wheat region, with a watch on crop conditions after strong winds likely caused some damage. The BSEA is still dry, with little rain expected over the next two weeks. Locally, WA has recorded some good falls over the last week, giving growers confidence to get the crop in early – with images of seeders starting to cut laps around the paddocks.

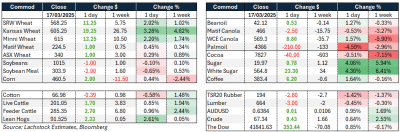

Markets: Wheat markets surged strongly overnight in the US, with dust blowing through the Southern Plains and a dry BSEA, with no reprieve in the 15-day forecast. Canadian canola was slightly firmer, suggesting that we may have seen the bottom of the recent freefall.

Australian Day Ahead: Offshore wheat markets were firmer overnight on the back of weather concerns in the US and BSEA. The AUD will likely cap many of these gains, and domestically, expect local bids to remain largely unchanged.

Offshore

Russian major wheat-growing regions are facing a 24 percent deficit in long-term precipitation, with weather forecasts predicting little rain soon. This will undoubtedly affect winter crop yields and could impact the upcoming spring planting.

In Brazil, the soybean harvest is progressing rapidly, with 70pc of the planted area harvested, according to AgRural. This marks the most advanced progress for this time of year in at least the last decade.

The Russian wheat export tax will decrease to US$28.54 per tonne, down from US$29.13 last week, nearly half of what it was at the start of the year. Russian wheat prices remain around $250, with export quotes in place. March wheat exports are expected to reach 1.5 million tonnes (Mt), a decline from 1.9Mt in February and 4.8Mt in March 2024.

In Brazil, domestic corn prices surged to their highest level since April 2022 by the end of last week. So far this year, prices have risen around 24pc, driven by strong demand for feed and ethanol and low inventories.

Export inspection numbers for the week are as follows: Soybean inspections totalled 646,667t, in line with expectations but continuing their typical seasonal decline. Wheat inspections reached 492,658t, exceeding forecasts. Corn inspections came in at 1,658,631t, meeting expectations and marking another strong week.

Australia

WA bids began the week largely lower, with canola down around A$5, bringing bids to approximately $785, and GM at $660. Wheat also dropped $5, with bids at $365, while barley remained steady at a bid of $358.

In the east, bids were mostly unchanged at the start of the week, with canola bid at $738, and GM stronger at $640. Wheat held steady at $346, and barley was bid at $322.

Faba bean demand remains strong in Victoria through containers, with bids around $645 for prompt delivery.

The AUD/USD reached a 3-week high in the upper 0.63 range, driven by weaker US retail sales data that led to a drop in the DXY.

Barley demand continues to be strong in South Australia and Victoria, supported by good lamb feeding margins and ongoing dry conditions leading to significant hand feeding. Delivered bids in Geelong/Melbourne markets are around $350 for April/May delivery.

HAVE YOUR SAY