The day ahead

Weather – The still before the storm. A pretty low rainfall week globally – a good thing for some areas. The US winter crop belt was pretty clear but, according to the European model, OK, KS and TX are set for 1.5-3 inches over the next week. The US drought monitor is still showing the Dakotas and Montana has having areas rated as being in extreme drought. Wet and hot in China, Black Sea rainfall is running around 4 inches behind normal for the last 180 days. Qld set to get 50-80mm over the next 7 days.

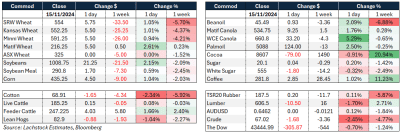

Markets – A wild week. Winnipeg canola rallied C$33/t on Friday night, but managed to finish within 0.65 percent for the week. Wheat futures were down 4-5pc for the week while the AUD now has a 0.64 handle. Crude also found sellers, down just under 5pc for the week.

Markets – A wild week. Winnipeg canola rallied C$33/t on Friday night, but managed to finish within 0.65 percent for the week. Wheat futures were down 4-5pc for the week while the AUD now has a 0.64 handle. Crude also found sellers, down just under 5pc for the week.

Australian day ahead – Consistent if nothing else. AUD providing all the relief and, while US futures managed to show some limited strength on Friday night, it is all about the AUD. Russia cash found support into the end of the week but was still US$5/t down. With some rain delays across the country, expect there to be some positioning – trade was motivated last week, particularly in the West. Firm today across grains and canola.

Offshore

According to the Australian Lot Feeders Association, cattle on feed remained above 1.4 million head.

Australian grain fed beef exports reached a record surpassing 100kt. This equates to the Australia feedlot sector growing 24pc in the past five years. The drought in the US has been a huge leg up for the Aussie grain feeder with beef exports to the US increasing 59pc.

Australian grain fed beef exports reached a record surpassing 100kt. This equates to the Australia feedlot sector growing 24pc in the past five years. The drought in the US has been a huge leg up for the Aussie grain feeder with beef exports to the US increasing 59pc.

“Individually, our top three markets have remained solid,” MLA senior market information analyst Erin Lukey said.

“Japan remained our largest grain fed market, despite a 9pc reduction, making up 32pc of all grain fed exports.

“China made up 25pc of export share, while Korea made up 21pc of exports.”

Matif wheat shorts grew over the past week while Matif canola longs also added to their record position. It would be too simple to assume it is a spread trade. I can’t emphasise enough, these futures markets haven’t seen this kind of positioning before so predicting the exit is a guessing game.

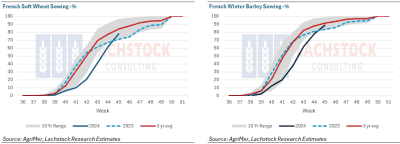

French planting climbed into the band of normal progress. Heavy rain forecast this week is set to cause more delay. Click expand.

In the case of wheat, the previous record short was in Dec/Jan last year. The short got out to -164k contracts vs today at -166k. The massive difference however is the jump in open interest – meaning that the actual amount of shorts vs longs is up more than 50k contracts. This simply means it is becoming an elevated game of the spec vs the commercial. It feels like we are watching a car crash in slow motion.

French planting got back into the historical range, getting another 16pc of soft wheat and 11pc of winter barley in the ground. This week should see widespread rain across the country – up to 90mm in some areas which should slow planting again.

EU shipments of common wheat, or soft wheat, so far in 2024/25 are 30pc below the year-earlier level, curbed by Russian-led competition and a rain-hit harvest in top EU grower France. EU data shows Nigeria is currently the top destination, while previous leading outlet Algeria is only in fifth place.

Australia

In the west, canola ended the week being bid around A$850, largely unchanged from Thursday. GM bids lost $12 to be bid $740. Barley bids remain around $325 with a strong export program ongoing for the west. Wheat bids were up $5 to be bid $375 FIS.

In the east of Australia, canola was bid around $810, losing a few dollars on Thursday, with GM bids $60 below conventional. Wheat was bid $343, and barley $310.

Record grain-fed beef exports were recorded for the September quarter, surpassing 100,000t, along with record cattle-on-feed numbers for SA and NSW.

Rainfall looks to be building for most parts over the next 14 days. Over the next week, most of Western Australia can expect 25-50 mm, SA and Vic 15 mm, and Qld 50 mm for most parts, with large parts forecast to see closer to 100 mm. There were some storms that rolled through parts of WA and small pockets of SA, which brought heavy falls and isolated hail. What influence this has on quality will become evident in the coming days.

HAVE YOUR SAY