Weather: Rostov (Southern Russian growing belt) spent the weekend a little under minus 10°C while in the US Enid Oklahoma was much the same. Colby Kansas was even colder at minus 20°C. Moisture remains the issue in Russia with nothing forecast. Meanwhile, Rosario, Argentina, helped slightly by the fact they got 50mm early last week, is set to get to almost 45°C in the next few days.

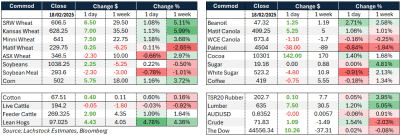

Markets: Wheat continues to price in risk premium with global conditions eroding production outlooks. TX crop conditions took another hit, dropping 3 points on the good to excellent rating to 33pc. Feels well supported at the moment.

Australian Day ahead: All about the rate cut. Market moves around these big announcements are more about what the market does vs the guess rather than the actual print. It was clear that some of the positioning was pricing a “what if” there was a larger cut. AUD actually rallied after the announcement, but is pretty much back where we started. Expect numbers to be well supported today.

Offshore

Wheat continues to find support with global weather challenging at best. The cleanest reflection of this has been the slide of crop conditions in the southern HRW wheat belt. The Texas crop good-to-excellent rating is 33 percent. OK is 40pc while KS is at 50pc. Both OK and KS are due to release their updates next week which will be interesting. The most concerning wheat region of the world remains Russia. I am sure if Russia released a weekly crop update there might be more fanfare. I keep looking at the temp swings and lack of snow cover and low moisture and wonder why we are not trading higher.

Recent USDA baseline wheat projection has world wheat trade expanding 9.4pc by 2033/34. It sees China decreasing as population passes its peak and farming practices improve. The major exporters largely are projected to be the same. Russian exports are expected to increase to 51.7 million tonnes by 2033/34. Better learn Russian!

President Donald Trump is considering a 25pc tariff on automobile, semiconductor, and pharmaceutical imports, with an announcement expected as soon as April 2. The goal is to encourage companies to establish factories in the US before new tariffs take effect.

Indian domestic wheat price is close to recent highs with supply concerns domestically which might see tariffs come off and turn on some exports.

Australia

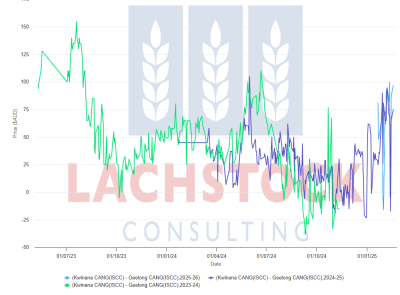

Canola price spread Kwinana (mostly premium) compared with Geelong, July 2023 to present. Green line last season, dark blue current crop and light blue new crop. Source: Lachstock. Click expand.

WA canola yesterday was bid A$850. Wheat, holding on to Monday’s gains, was bid $375 and barley $347. New crop GM bids are around $762 which is a $40 spread to conventional vs a $110 for current crop.

In the east it’s more of the same. Canola is bid up a little to around $780, wheat is $352 and barley $318. New crop GM bids in the east are around $665 a $100 discount to WA.

Delivered Downs wheat is trading around $343 and barley $324. New crop wheat is bid around $365.

GM canola delivered Melbourne/Geelong packers is still in demand, with bids around $700-$705, around $50 higher than current port prices.

HAVE YOUR SAY