The day ahead

Weather – almost think we stop talking about the weather for a while. 35°C in Adelaide for Christmas is probably the only exciting sound bite today.

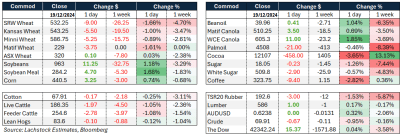

Markets – Wheat bleeds. Historically, Chicago wheat always struggles with a ripping USD – seems we are in the same space. Strong wheat export sales tell a different story however so the baffling close to 2024 continues.

Markets – Wheat bleeds. Historically, Chicago wheat always struggles with a ripping USD – seems we are in the same space. Strong wheat export sales tell a different story however so the baffling close to 2024 continues.

Australian day ahead – No bounce in the AUD keeps the status quo. Domestic wheat has been on the slide, almost in line with US futures but for different reasons. Export parity calcs are compelling but it does not feel like the fundamental potential tightness in the balance sheet matters right now. Probably slightly lower today but liquidity evaporating quickly.

Offshore

South Africa dropped its wheat crop estimate slightly from 1.94 million tonnes (Mt) to 1.935Mt, 5.6pc smaller than 2023 crop.

French soft wheat ending stocks at the end of 2024/25 season is now seen at 2.87Mt vs the Nov estimate of 2.79Mt, according to Agrimer.

The proposed sweeping tariffs on US imports could indeed have far-reaching implications for the American agricultural sector. US trade policy analyst Ed Gresser warns of the interconnected nature of global trade. He references agriculture in particular because it relies heavily on stable export markets.

Key points to consider:

- Impact on Farm Income: A potential loss of up to 10pc of farm income is significant. For many farmers, especially those already operating on thin margins, such a drop could lead to financial distress, reduced investment in operations, or even bankruptcy.

- Destabilization of Trade Agreements: Disrupting the United States Mexico Canada (USMCA) could erode the tariff-free trade advantages with Canada and Mexico, which are vital export markets for US agricultural products like corn, soybeans, and livestock. This could lead to increased competition from other countries filling the void.

- Chinese Market Challenges: Tariffs on Chinese goods could provoke retaliatory measures, further reducing US agricultural exports to China, which have already been under strain. Given China’s role as a major buyer of US soybeans and pork, this would compound the challenges for American farmers.

Wheat net 2024/25 sales this week totalled 457,900t, representing a 58pc increase from the previous week and a 16pc rise compared to the 4-week average. The main contributors to the increase were the Philippines (83,000t), Venezuela (80,800t), Japan (59,300t, after accounting for a reduction of 800t), El Salvador (56,000t), and Vietnam (33,500t, including a reduction of 5,000t). These gains were partially offset by a reduction of 8,200t for Panama. Exports reached 405,700t, showing a significant increase from the previous week and a 49pc jump from the 4-week average. Key destinations included Venezuela (80,800t), Japan (66,000t), Mexico (60,100t), Thailand (59,300t), and El Salvador (50,000t).

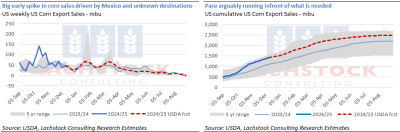

US corn export sales reports. The graph on the left, by week, where big early sales were driven by destination Mexico and “unknown”. Right, 2024 cumulative, showing that the pace arguably is running ahead of what is required to achieve full-year forecast. Million bushels

Australia

WA canola bids, at around $850, largely were unchanged yesterday. GM bids were closer to $700. Cereals were steady, with barley bid around $320 and wheat $380.

Prices in eastern Australia were down across the board yesterday, even accounting for the support given by the lower Aussie dollar. Canola bids were down around $23 to $764, with GM at $663. Wheat was $5 lower, bid at $345, and barley bids were $2 lower, around $308.

Pulse bids were supported by the lower dollar, with faba bean bids gaining about $20, compared with the Wednesday price, to about $605 delivered Geelong/Melb for Jan+.

GM canola delivered Melbourne packers is being well supported by the container market, with bids, at around $700, a $40-$50 premium to port prices.

HAVE YOUR SAY