Weather: The Midwest of the US experienced well below normal temperatures, with scattered showers in the southern regions. The Central and Southern Plains saw isolated snow, and temperatures remained well below normal through Friday. Argy – Central regions received beneficial rainfall, further supporting reproductive corn and soybean development. However, northern areas experienced hotter and drier conditions, increasing stress on immature summer crops.

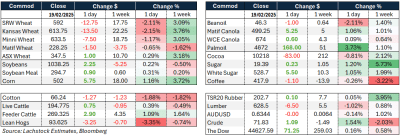

Markets: Profit taking on a stronger USD and some snow with the cold through the Mid-West motivated the sellers last night. Wheat has an amazing ability to get you bullish, only to squash you – just cannot see a sustained break while Black Sea weather looks this way.

Australian Day ahead: Demand is here but the pain is mainly domestic. Asian buyers are asking questions but they are being outbid by the local delivered markets today. more of the same today with offshore moves largely ignored.

Offshore

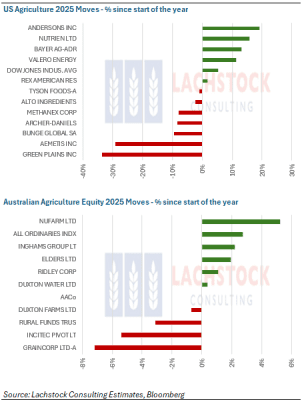

Agriculture equities in US (top chart) and Australia (lower chart) in calendar 2025 are mixed. Source Bloomberg via Lachstock. Click expand.

The Fed set the tone yesterday, as their minutes revealed a more cautious approach to rate cuts than the market was looking for. This added a bid to the USD and commodities felt the sell pressure. Adding to the “lets not cut rates” camp was Donalds throw away line that he might hand back a chunk of the cash the inglorious DOGE crew finds to the tax payer.

While on Donald, he threw out some more sound bites that had market implications – the most notable of which was telling Zelenski he better hurry up to reach a deal with Vlad or he wont have a country left. The cherry on top was his praise of the Russian Foreign Ministers comments laying the blame for the conflict at NATO’s feet.

French farmers planted 6.35 million hectares of winter grains for 2025, up 7.2% from 2024 but 1.3% below the five-year average. Poor soil conditions in some regions may impact yields or require reseeding. Soft winter wheat rose 10% to 4.57 million hectares but remains historically low.

The USDA released Texas winter wheat conditions for the week ending Feb. 16, showing a 3-percentage point decline in crop conditions from the previous week. Crops rated poor rose by 6 points to 24%. Texas is the second largest winer wheat producer in the US.

Jordan launched an international tender on Wednesday to buy up to 120,000 tonnes of milling wheat, with sourcing from optional origins. The deadline for price submissions is set for Feb. 25.

Australia

In the west of the country, canola bids were firmer at around $860, with wheat at $380 and barley at $348, as strong barley exports continue from WA.

Through the east of the country, canola was firmer, bid at $785, with GM bids at $677. Wheat bids were steady, bid at around $350, with barley firmer at around $320.

Barley demand is strong through SA and Victoria, with sheep feeding in earnest and strong demand from the feed mills. Western District delivered barley markets are trading around $340–$345, with SA markets at a similar level for prompt delivery.

The Griffith market zone has rallied around $40 since the beginning of the year, with April delivery of ASW at around $340. This market has been dragged along by the SA market, which is close to pricing SNSW grain, coupled with low levels of grower selling.

HAVE YOUR SAY