The day ahead

Weather – Oh Canada. Cold and wet. Precipitation, both in the form of rain and snow, is on the way mainly in Saskatchewan and into Manitoba but it does stretch into the US northern areas. US has a pretty clear window for the next 7 days. Rinse repeat in the EU and Russia. Aussie set to get rain in Qld, Southern NSW, SA and WA. Not ideal if you are not growing sorghum.

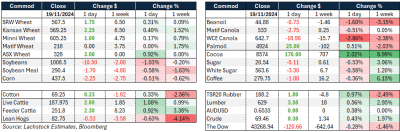

Markets – Sharply boring. Wheat managed to hold yesterday’s small gains but did close well off the intra-day highs. The bean complex was lower, and Winnipeg canola continued its schizophrenic trading behaviour. The approval and subsequent use of US-made ballistic missiles by Ukraine was the main input last night but, honestly, I’m not sure the Ag markets know what to do with that info.

Markets – Sharply boring. Wheat managed to hold yesterday’s small gains but did close well off the intra-day highs. The bean complex was lower, and Winnipeg canola continued its schizophrenic trading behaviour. The approval and subsequent use of US-made ballistic missiles by Ukraine was the main input last night but, honestly, I’m not sure the Ag markets know what to do with that info.

Australian day ahead – Status quo. Bids should remain at similar levels in the southern belt. Qld and northern NSW are grappling with an amazing sorghum outlook on the back of a record winter crop.

Offshore

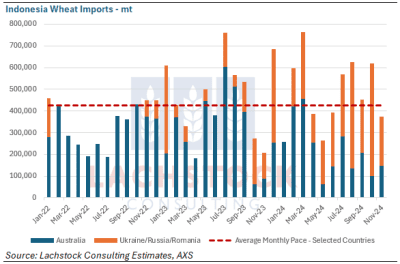

Since May 2024 Ukraine, Russia and Romania (orange column) have outpaced Australia (blue) monthly wheat supply to Indonesia.

On day 1000 of the war between Russia and Ukraine, it certainly feels like we have entered a new phase, one that is significantly more impactful. Ukraine forces carried out their first ATACMS missile strike overnight, targeting the border regions. This prompted Vladimir Putin to approve an updated doctrine which expands the conditions of using atomic weapons. Russia will consider any aggression against itself or its allies by a non-nuclear state supported by a nuclear power as a coordinated attack.

Equally uncertain, the markets are trying to preempt what Donald Trump inevitable tariff policy escalation can do to US values. It seems like a lifetime ago but when he initially slapped tariffs on China it also included a trade deal that had minimum requirements of China purchases of US Ag products. Referred to as Phase One (there was a Phase Two and Three that did not get implemented) when announced, was actually bullish for US products initially. Worth pointing out that, from a macro perspective, China was flying at the time and not flying so much today. Additionally, Mr Trump is talking about slapping as much as a 60 percent tariff on Mexico if it does not clean up its side of the border.

The Fed upcoming Dec meeting is the most debated for a while. The street is mixed on the decision, unchanged or a 25-point cut. The forward rate curve is pricing in a 10-15bp cut.

Australia

Canola bids in the west were well supported yesterday, up A$8 to be bid $880 and $770 FIS. Cereals were steady, with barley being bid $326 and wheat $375.

In the east of Australia, canola bids were softer, losing around $4 to be bid $807. Barley bids are around $300 with a $15-$20 spread for malt. Wheat bids were a touch firmer yesterday, being bid $343.

Total grain on the stem for November currently sits at 2.1Mt, up from 2.09Mt. Wheat has gone from 803kt to 1.09Mt, barley is steady at 630kt, and canola is down from 660kt to 345kt.

Some more big falls through the Darling Downs yesterday, with 25-50mm for most parts and closer to 100mm in some isolated areas.

Viterra receivals in South Australia have now reached 1Mt as of 17 November, with the bulk of these through the western region. Most of these deliveries for the past week were wheat, followed by barley and then canola.

HAVE YOUR SAY