Weather: Argentina rainfall is helping the country’s corn crop prospects, BAGE conditions finally improving, breaking a 6-week run of lower scores. Indian weather is hot and dry affecting the country’s wheat crop.

Markets: Wheat markets are down and it is feeling like we are at a standstill waiting for further developments to Black Sea peace talks and weather risks out of Russia and the US. Canola markets were stronger overnight, following soybeans and soybean oil higher on the back of China trade deal and talks of lower US soybean plant.

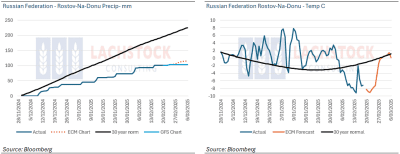

Rostov-on-Don cumulative rainfall, chart on the left, and periodic temperature on the right. Rainfall (dark blue line) is very much below mean (black line). Temperatures first half February fell below mean but are forecast to return to normal in the next week. Source: Bloomberg via Lachstock

Australian Day ahead: Aussie dollar sharply higher to 64c and wheat futures down expect to see bids back a little today but the strong domestic demand providing a strong base to the bids. Canola well supported today with both Winnipeg and Matif higher overnight along with global soybean complex.

Offshore

IGC estimates for 2025–26 show a further drawdown in world wheat stocks to 264 million tonnes (Mt), compared to 265Mt last month and 273Mt last year. World wheat stocks (excl. China) was steady at 124Mt (133Mt last year). The IGC estimate for China imports was reduced by 1.5Mt to 7.7Mt (compared to USDA 8Mt).

Weekly US wheat export sales data is delayed 24hrs due to Monday’s holiday, 450kt expected compared to 569.5kt last week.

The Taiwan Flour Millers Association purchased 102,450t US wheat in a tender overnight.

Japan purchased 96,160t of wheat via its usual weekly tender from the US, Canada & Australia, 27,060t bought from Australia for May shipment.

India’s warm, dry weather is threatening wheat crops, possibly prompting import duty cuts. The northwest, a key wheat region, has seen 80 percent less rainfall this year, per the India Meteorological Department.

Cattle ended lower overnight in both live and feeder cattle futures on fund long liquidation and positioning ahead of the USDA Cattle on Feed Report.

Australia

WA canola bids yesterday were steady at around $855 FIS, wheat down a little was bid around $374, barley was still well supported bid around $348.

In the east of the country canola bids were around $782 down a little on Wednesday’s bid. Wheat was steady despite global futures working lower well supported by domestic users. Barley bids were around $320.

Faba beans continue to be well bid with prompt delivery into Geelong/Melbourne around $630-40, new crop bids are indicated to be around $530 for harvest delivery.

The USD retreated overnight allowing the Aussie dollar to reach 0.64, a high for 2025 buoyed by strong metal prices currently.

HAVE YOUR SAY