The day ahead

Weather – Central France got a little under 2 inches, but the areas still planting should only see small delays. Clear skies over the midwest of the US. Snow is likely through Illinois and the Dakotas up into Canada. Accumulated falls in Western Australia not getting towards 2 inches in some areas with SA set to receive something similar.

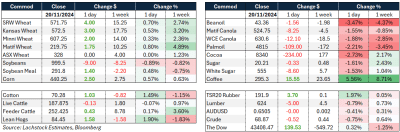

Markets – War premium. Wheat traded lower early but funds started adding to the bid side, logically driven by the escalation in the Russia/Ukraine war. It is not an easy one to trade given any rallies over the last 1000 days fuelled by the war have fizzled out. Beans were on the back foot all day and the Aussie dollar remains anchored to 0.6500.

Markets – War premium. Wheat traded lower early but funds started adding to the bid side, logically driven by the escalation in the Russia/Ukraine war. It is not an easy one to trade given any rallies over the last 1000 days fuelled by the war have fizzled out. Beans were on the back foot all day and the Aussie dollar remains anchored to 0.6500.

Australian day ahead – WA wheat was the talking point going home yesterday with nearby APW hitting A$400/t, a level not seen since June this year when US futures were US$2/bu higher than today. Short covering for nearby shipments is the broad brushed explanation but now the question will be, can this be sustained. East coast will certainly be keeping an eye on WA today with Kwinana FIS values A$40 over Port Kembla track.

Offshore

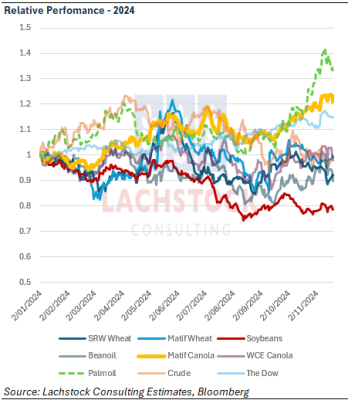

MATIF rapeseed has made strong price gains this year along with palmoil. Matif wheat ( royal blue line) has had a rollercoaster ride. Soybeans have slipped 20 percent. Click expand.

What now. The escalation in the Russian conflict is nothing short of scary. With President Putin putting the US on notice for its involvement in the decision to use their missiles to hit an interior Russian target, this feels a little different. The timing of President Biden giving the green light is something of a mystery for me. Donald Trump was clear what he thought but there is still plenty of time between now and the inauguration for things to spiral. Given the Russian and Ukrainian supply chains are both humming at the moment, it can only restrict the current pace should things escalate. Hence the fund community is looking for ways to express this trade.

Reports that more wheat is being registered for Nov/Dec export from Argentina supports the view that it will be a major competitor for Australian wheat into Asia.

Despite the rain through the US, the Mississippi water levels at Memphis continue to fall and will lead to even more restrictions for barge traffic.

The Israel-Hamas conflict continues, with Israel targeting Hezbollah in southern Lebanon and facing Houthi drone and missile attacks in the Red Sea. These dynamics have heightened fears of broader regional escalation, though global oil prices remain relatively stable due to factors like increased US production and slowing demand from China.

In the UK, farmers are lobbying against proposed changes to inheritance tax, fearing it could undermine the viability of family farms. Protests and advocacy efforts aim to influence policymakers before decisions are finalised. Media personality Jeremy Clarkson was among those advocating for farmers at a recent rally.

The Russian Agriculture Ministry has announced adjustments to export duties on grain, effective from November 20 to November 26. The wheat export duty has increased by 4.7%, rising to ₽2,689.7/t (roubles per tonne) from ₽2,569.2/t in the prior period. Barley decreased to ₽1,233.2/t, from ₽1,367.4/t and corn to ₽3,065.5/t from ₽3,288.4/t

Australia

Yesterday it was wheat’s turn in the spotlight in Western Australia, with APW bid up around A$25 to $400, with a $20 spread to H1 as protein remains in demand. Canola was still well supported, bid at $875, with GM at $755. Barley bids were steady around $325.

In the east, canola was down around $7 to be bid $800 yesterday, with a $62 discount to GM. Cereal bids were largely unchanged.

Faba bean demand was still evident in Victoria, with some delivered markets closing in on $700/t delivered for Jan+ as the trade shorts look to shore up supply.

There were some decent falls through the Central, Midlands and Upper Great Southern regions of Western Australia yesterday, many receiving about 25-50mm. It was enough to pull up harvest for a few days and raise some concerns around quality, particularly wheat, which will be answered in coming days.

HAVE YOUR SAY