The day ahead

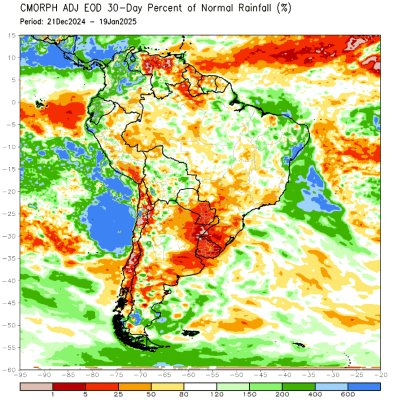

Weather – not enough rain has fallen in Argentina, and the 7-day forecast does very little to ease the concern. Buenos Aires is in slightly worse condition than Cordoba, these 2 provinces account for ~65 percent of the corn & soybeans production. In Brazil, excessive rains over the past week in Mato Grosso is further delaying what has been a slow start to soybean harvest pace.

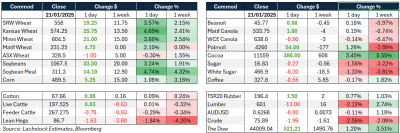

Markets – A strong move up for wheat and soybeans overnight was largely on the back of President Trump not implementing tariffs on day 1 and perhaps taking a more considered approach. Canada remains in the crosshairs, so the canola market did not follow suit.

Markets – A strong move up for wheat and soybeans overnight was largely on the back of President Trump not implementing tariffs on day 1 and perhaps taking a more considered approach. Canada remains in the crosshairs, so the canola market did not follow suit.

Australian day ahead – With a strong move up in global wheat futures overnight and a largely unchanged AUD, eye’s will be on exporters to see how much is passed on. With current modest fresh engagement on wheat export expect this not to be 1:1.

Offshore

President Trump’s first day in office was more of a considered one than many thought with no immediate announcement of tariffs, with his administration opting to evaluate trade relationships with various countries as part of the America First Trade Policy.

Argentina rain received over 30 days to January 19 is less than 25 percent of normal. Source: NOAA via Lachstock

Recent rains in Argentina’s agricultural heartland have not alleviated concerns that ongoing drought could further hurt crop yields” the Rosario Grains Exchange said in a report released overnight.

US Export Inspections data showed 261.8kt of wheat shipped in the week of January 16, a drop of 37.4kt from the week prior. Mexico was the top destination followed by South Korea. Shipments for the current marketing year total 13.279 million tonnes, an increase of 24 percent from last year.

Managed commodity funds continue to add to their net long position in CBOT corn. They are also now net long CBOT beans, the first time in a little over a year.

Australia

WA canola bids yesterday were largely unchanged around $845 FIS. Wheat was slightly firmer around $372 and barley $330-$335 with only a $5 spread to malt currently.

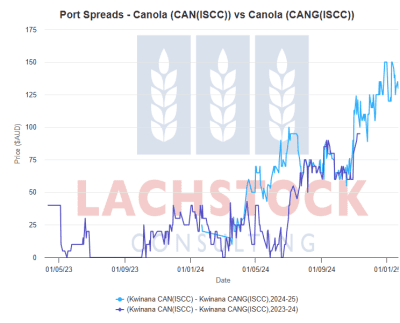

The spread in 2023-24 crop (dark blue line) canola between GM and non-GM exceeded $A50/t in the last half of 2024. Current crop spread (light blue line) rapidly increased from about $50 to almost $150/t.

All commodities were steady in the east of the country with canola bid around $800, wheat $345 and barley $310.

Delivered Newcastle and Brisbane sorghum bids have been working higher over the last fortnight from $345 to around $353, as positive export margins continue to engage exports.

The current GM canola spread is historically very wide reflecting the current situation Canada faces, although with what appears to be a more methodical approach to tariffs from President Trump we might see this spread begin to close to historically more normal levels. Timing of his decision will be crucial as planting decision for the upcoming 24/25 season begin to be made.

HAVE YOUR SAY