The day ahead

Weather – The all important Southern Region in Russia finally got a drink as did the better part of the Ukraine. Falls are building through France, it will be interesting to see how much they got planted this week and what shape the crop is in. The front that dropped between 1 and 2 inches across Western Australia has its attention on SA and Vic with the GFS indicating 60-90mm in the Wimmera and Western Districts. Where was this during the growing season.

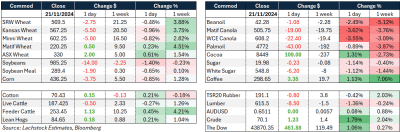

Markets – The Trump Trade (now a thing) was back on last night with equities and crypto both higher as the world considers less regulation when Donald Trump has the oval office. Grains were slightly lower but it was vegoil that got slapped.

Markets – The Trump Trade (now a thing) was back on last night with equities and crypto both higher as the world considers less regulation when Donald Trump has the oval office. Grains were slightly lower but it was vegoil that got slapped.

Australian day ahead – WA wheat took the foot off the gas but still felt like it has unfinished business. Grower transfers are logically slow with a bunch of new grades and growers desire to get to the end of harvest before they optimise loads. East coast all about getting busy before the rain.

Offshore

US corn export sales to unknown destinations are 7.145Mt. It is a record for this time of year and is hard to explain. It would be too convenient to assume destination China, but, if not China, then where?

USDA weekly export sales summary had soybean cake and meal net sales totalling 274,900 metric tonnes, slightly below the previous week but above the 4-week average. Major buyers included Mexico, The Philippines, Denmark, and the Netherlands. Exports were primarily directed to The Philippines and Denmark. Soybean oil net sales were 21,900 tonnes, with South Korea and Venezuela as major buyers and exports totalled 16,300 tonnes, with Colombia as the primary destination.

Corn export sales declined. Japan and Mexico were significant destinations.

Wheat sales remained stable, with strong demand from Southeast Asia.

Cotton sales reached a marketing-year high of 318,500 running bales, with Vietnam, Pakistan, Turkey, and China as major buyers. Exports rose by 32pc, with Vietnam and Pakistan key destinations

Australia

WA canola bids were down about $20 yesterday to $855. WA wheat bids remained strong at $390-$400 and barley bids also gained about $5 to $330 FIS.

In eastern Australia canola bids were off $10-$15 yesterday, to about $795. Wheat found a little support but not to the same extent as in the west. Bids were up $2-$4 to around $345. The west premium over eastern price was about $50. Barley bids were unchanged at around $310.

Prompt demand for feed barley into end users through SNSW and Northern Vic is providing good alternatives for deliveries off the header at premiums about $15-$20 over cash bids at sites.

Delivered Darling Downs markets for Jan+ are bid around $345 for wheat and $320 for barley.

HAVE YOUR SAY