Weather: Russia, and a big part of the US HRW belt, should see some decent snow with the latest cold snap which, according to the market, should protect it from any winterkill damage. As with a frost event in Australia, it takes time to assess damage. Remember that Colby KS temperature swings have been crazy. It was almost 17°C at the beginning of the month, then was minus 24°C on the February 20.

Markets: After printing a low of 526usc/bu in March Chicago wheat last month, the market printed 609 on February 18 – yesterdays close at 579usc/bu highlights we are in a weather market and forecasts will drive value. AUD back into mid 0.63s which will provide some relief.

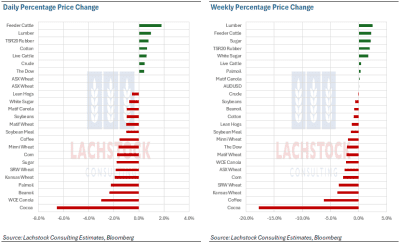

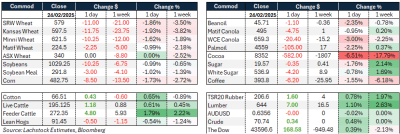

Commodities prices. Day-change chart LHS and week-change RHS. Percent. Source: Bloomberg via Lachstock. Click expand.

Australian Day ahead: Arguably, the fact that Russian values have improved has more relevance to the ups and downs of Chicago. FOB values across the board are more interested in the tightness coming before Northern Hemisphere new crop rather than the capital flow of a futures market. Some rain showing on the back end of the east coast forecast may get a few excited but hard to see values changing massively today.

Offshore

USDA will hold its 101st Annual Agricultural Outlook Forum with the theme “Meeting Tomorrow’s Challenges Today” over two days beginning Feb 27.

USDA reported cattle on feed down 1 percent as of Feb 1, totalling 11.7 million head. January placements were 1.82 million, +2pc above year ago, and marketings 1.87 million, +1pc above.

Mexico and Canada are beginning negotiations in earnest prior to March 4 when the 25pc US tariff is due to be implemented on their exports to the US. Border security and fentanyl control are at the forefront of these discussions.

Canada has shipped 5.85 million tonnes (Mt) canola this marketing year so far, out of a projected 7.5Mt, and continues to push seed out at more than 150kt a week.

Brazilian agribusiness consultancy AgRural slashed its Brazilian soybean production estimate by 2.8Mt to 168.2Mt, primarily due to declines in Rio Grande do Sul. As of last Thursday, the soybean harvest had progressed to 39pc, nearly on par with last year’s 40pc at the same time.

Algeria’s OAIC tendered for milling wheat on Sunday, seeking shipments to Mostaganem or Tenes between April and June. European supply is preferred, while South American and Australian wheat must ship a month earlier.

China is reportedly considering ending its anti-dumping investigation into Canadian canola seed, a move that could ease trade tensions between the two countries.

Australia

WA canola started the week mixed, bid to around $860, wheat was unchanged around $380 and barley bid $348. New crop canola was $810 and wheat $389.

Through the east of the country canola was a touch firmer bid $783, with wheat $348 and barley $318 largely unchanged from last week. New crop canola was $760 with wheat $371.

Corn harvest is about to begin through the river region in SNSW and Vic, currently pricing around $340-$350 delivered local mills.

Domestic end users are finding grower selling relatively sticky through southern regions, dry conditions see growers happy sit on the sidelines for the most part and let the market come to them.

HAVE YOUR SAY