The day ahead

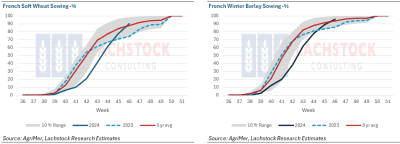

French planting progress (dark blue line) exceeds pace of 2023 and has surpassed the 5-year average. Click expand.

Weather – The Black Sea, both the eastern Ukraine and the Russian central belt got some decent rain over the weekend. This will help shore up crop in that region but really will not be traded until we come out of dormancy. US was clear, France did not get too much rain but they are pretty much planted now.

Markets – The ability of Ag markets to ignore what is at risk of becoming a world war is amazing. We had an escalation in both action and talk with Russian President Putin doubling down on his “Oreshnik” missile, indication that there are currently no ways of countering this weapon. We had Dec option expiry in the US, but the markets simply do not care.

Markets – The ability of Ag markets to ignore what is at risk of becoming a world war is amazing. We had an escalation in both action and talk with Russian President Putin doubling down on his “Oreshnik” missile, indication that there are currently no ways of countering this weapon. We had Dec option expiry in the US, but the markets simply do not care.

Australian day ahead – Rain – parts of the WA, SA Vic and NSW belt all got rainfall, although it was Qld that got the medal for the most over the last 7 days. The east coast is not out of the woods with another 15-35mm in the front end of the forecast. It is all about grower marketing pace – as we saw in WA, growers are dragging their heels and the trade with short term vessels would be a little nervous.

Offshore

Global markets have a clear directive – only trade facts. The facts are, if you want to buy wheat, you can. Yes, there is constant exposure to Russia and the Ukraine slowing in some fashion, be it through some shift in the war and/or that they have simply sold enough, but that is conjecture, and the market does not care.

One of the more opaque impacts of the escalation has been the Ruble. It traded down to a 13-month low against the USD, once again enticing the grower to stay active.

RBA is a broken record. It will not cut rates until it has to. There is a wedge of data out in the US this week, most tradable will be the FOMC meeting minutes which will be trawled over, looking for any signs in a shift there. Technicals start to weigh on the Aussie here and with little signs of life from China, it feels like rallies get sold.

An article in Bloomberg over weekend has called for China growth to slow from the close-to-5pc to a more moderate 4.5pc. This view is as a result of an expected $300 billion impact due to Trumps impeding tariff increases.

Palmoil exports from Malaysia fell more than 5pc in the first 20 days of Nov from a month earlier. Shipments to India dropped 42pc while sales to the EU fell by 30pc

Australia

In the west, canola bids were off around A$45, to end the week around $811 and $705 for GM. Wheat bids finished the week around $375, up around $15 for the week. Barley bids were a little stronger to be bid $330 FIS. Canola bids in the east were down $40 to $755, with the spread to GM around $80. Cereal bids were largely unchanged: wheat $345 and barley $308.

Some widespread rainfall is forecast for eastern states this coming week, with 50mm forecast for most of Vic, NSW, and Qld. Northeastern Vic and NSW are likely to receive closer to 100mm. This follows some decent falls through South Australia’s Northern and Murraylands regions over the weekend, where between 25-50mm fell over large parts of these regions.

HAVE YOUR SAY