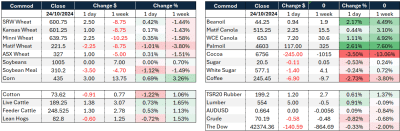

MATIF wheat eased 1 percent. US wheats gained a little. Canola gained 1 percent.

- Chicago December 2024 wheat up US3c/bu to 581.5c/bu;

- Kansas Dec 2024 wheat up 1.5c/bu to 587c/bu;

- Minneapolis Dec 2024 wheat up 2.5c/bu to 618c/bu;

- MATIF wheat Dec 2024 down €2.25/t to €221.50/t;

- Corn Dec 2024 up 2.5c/bu to 421.5c/bu;

- Soybeans Nov 2024 down 1.25c/bu to 996.25c/bu;

- Winnipeg canola Nov 2024 up C$6.40/t to $638.60/t;

- MATIF rapeseed Nov 2024 down €1.25/t to €508.50/t;

- ASX Jan 2025 wheat up A$1/t to $327/t;

- ASX Jan 2025 barley up A$1.50/t to $285/t;

- AUD dollar up 6 points to US$0.6640.

The day ahead

Weather – Push/Pull. Better conditions for planting in France offset by less rainfall and more heat in the Russian belt. Reports that Ukrainian winter crops could suffer from “poor development” is consistent with the recorded rainfall, although the western side of the country should be looking pretty good. HRW set to get a drink with the back end of the 14-day calling for 4-5 inches in parts of the very dry SRW belt.

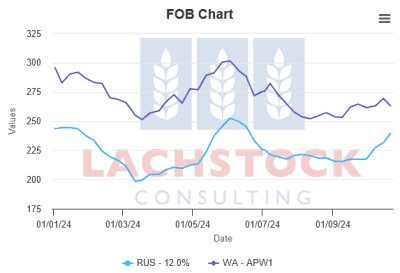

Markets – What’s driving what. After looking like the Russians were going to maintain their price targets, Russian FOB is looking a little soft today, only a few US$ but still below their target levels. Matif also is suffering from a lack of demand but, on the flip side, the US managed to sell 500k. US futures should find support from this export business, the fundamental push needed to break the technical deadlock. Vegoil continues to be the standout performer, despite crude finding sellers.

Australian day ahead – themes continue. Canola higher, wheat and barley sideways. AUD not posing any threat. The recent rally in Russian FOB had export parity numbers within sight. This support is academic however until the trade gets comfortable with a) production, b) quality, and c) grower selling. Until then, it’s a game of hurry up and wait.

International

The big soundbite overnight was the USDA attaché calling Aussie production at 28.5Mt vs the current WASDE at 32Mt. I seem to recall many a time that the folks in USDA head office refuse to take incoming calls from the Aussie attaché, so it is not a guarantee that they make this change in their next report. Safe to say, if they did, it would be a one for one adjustment to exports, currently sitting at 25Mt. This is probably the heart of the debate. Given cuts to SA and Vic, what is a realistic export number? If that looks closer to 20Mt we need to find some wheat or ration some more demand, especially in the first half of 2025.

In Germany, the implications of excessively wet conditions at the end of 2023 are still being felt. A local co-op suggests their 2024 grain crop could be the lowest since 2018.

The BRICS summit is an interesting twist on the announcement the EU is considering additional tariffs on Russian products, designed to apply more financial pain to Russia. Meanwhile, one of the key objectives of the summit is to find ways around the western sanctions and create a payment system that would essentially alleviate the impact of removing access to SWIFT. The Aljazeera news network reported that President Putin welcomed comments by US presidential candidate Donald Trump on his desire to end the war with the Ukraine. News services CNN and Fox will have a field day with this no doubt. 36 countries are attending the BRICS summit, many also calling for an end to the conflict. President Putin was reported as saying Russia was ready to look at any proposals for peace negotiations that are based on the realities on the ground and would not accept anything else.

Russia has exported 2.7Mt to Bangladesh between January and September 2024, an increase of 42pc from the same period last year. Australia has averaged around 300kt in the last three marketing years and has shipped virtually none this year.

Australia

Canola was still well sought after in the west yesterday with bids improving throughout the day finishing around $845 for conventional and $770 for GM. WA wheat and barley bids were largely unchanged.

In eastern Australia bids across all commodities were largely unchanged yesterday. Canola was still sought after but slightly softer.

Chickpea bids have seen a big fall over the past week with delivered Brisbane bids falling from $1035 last Thursday to $850 yesterday.

HAVE YOUR SAY