Weather: If you are looking purely at the futures market, both Russia and the US have received enough snow that there isn’t an issue with the recent cold snap in both growing belts. Rostov was minus 13°C yesterday and minus 15°C two days ago. Oklahoma got to a high of 23°C yesterday with temps forecast between 10-15°C for the next two weeks. Nothing to see here, apparently.

Markets: Wheat found some more selling based off the better forecast as risk premium trades were unwound. Chicago shrugged off reports that Russia will only forecast 42.2 million tonnes (Mt) in 2024-25 season.

Australian Day ahead: Swings and roundabouts – AUD will offset most of the move last night but the domestic market is now getting some more confidence around the big red blob in the back of the 15 day forecast covering most of the east coast.

Offshore

Black Sea market analyst SovEcon reduced its 2024-25 wheat export estimate from 42.8Mt to 42.2Mt (last year 52.4Mt), and said now the full export quota will not be used. It did increase its 2025-26 season export target to 38.9Mt from 38.3Mt given the increased carry over.

President Trump late Monday reaffirmed that tariffs on Canada and Mexico are set to move forward as scheduled, with the 30-day suspension on 25pc tariffs expiring next week. This uncertainty pressured CBOT grain futures on Tuesday, as both Canada and Mexico are major buyers of US agricultural products. Agricultural market analyst John Stewart & Associates noted that for corn, which recently hit a multi-year high, the tariff concerns were not supportive for futures.

Funds have swung from being 110,000 contracts short in WPG in December to being long 72,000 contracts today.

US consumer confidence in February saw its steepest drop since August 2021, falling for the third straight month amid growing pessimism. Average 12-month inflation expectations rose 0.8 percentage points to 6pc, driven by higher staple prices and expected tariff impacts.

The EU reported its year-to-date soft wheat exports at 13.65Mt versus 21.31Mt a year ago.

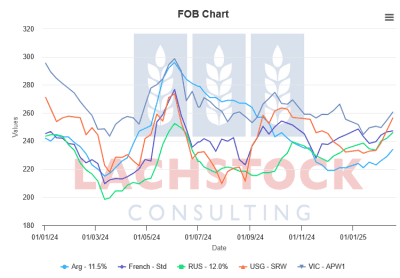

Wheat price Argentina, Russia, France, US Gulf and Australia (Vic). $US/t free on board. Source Lachstock.

Australia

WA canola bids were off yesterday to around A$850 with GM bids off around $25 to $725 on the back of Winnipeg futures Monday night. Wheat was down around $3 bid $376 with barley bid $348 underpinned by strong demand.

Through the east of the country canola was off around $10 to be bid $775 with GM bid $670. Wheat was steady $349 and barley $318.

Sorghum continues to be well bid with cheap container rates seeing strong demand with good quality/quantity for the early harvest giving exporters confidence to put early business on.

Finished lambs market remains well supported with the MLA heavy lamb indicator around $8.30/kg, providing strong margins for lotfeeders and adding to the domestic barley demand.

HAVE YOUR SAY