The day ahead

Weather – Really not much talk about. Clear skies across the world’s growing regions except for Australia and Argentina both of which are trying to get winter crop off. US had its wettest 30 days in much of the US winter wheat belt, reflected in the biggest October to November jump in crop condition ratings since 1992.

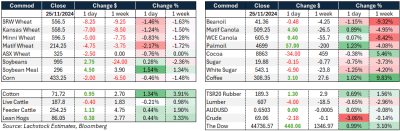

Markets – Markets rally on war, markets break on war. A big escalation on infrastructure damage yesterday for both sides. Hard to believe some are suggesting that the two sides are actually talking about a cease fire. Vegoils found some footing yesterday but it does feel like palmoil direction is driving the veg oil bus.

Markets – Markets rally on war, markets break on war. A big escalation on infrastructure damage yesterday for both sides. Hard to believe some are suggesting that the two sides are actually talking about a cease fire. Vegoils found some footing yesterday but it does feel like palmoil direction is driving the veg oil bus.

Australian day ahead – Rain – Eastern Australia is still debating the meaning of the rain that has fallen, and what this forecast means. According to the GFS there is circa 100mm forecast from Walgett to Bendigo.

Offshore

It’s more about the post session news than the actual session, because, with the weekly crop conditions report being released after the close US futures should find some selling.

The 17pc jump in good to excellent ratings from late Oct eclipses the previous jump of 8pc in 1992.

Romanian, Ukrainian and Russian wheat were all quoted slightly higher over the last week. Black Sea market analyst SovEcon forecast wheat exports lower, to 44.1Mt from 45.9Mt last update. It attributed the cut to the expectation that Russia would inevitably restrict exports, predicted export quotas could be imposed from mid Feb-June which could restrict exports to a maximum 10Mt.

2024 will go down as the year of elections. Romania is the latest. Little known pro-Russia candidate, Calin Georgescu, eliminated the current prime minister from the race in their primaries. This marks yet another EU country moving to the right, although the election is far from over.

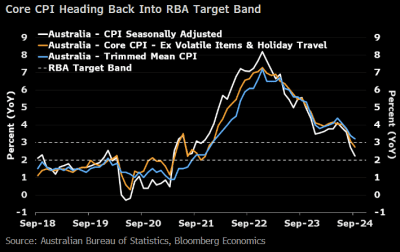

Australian CPI (dun line) is returning to the RBA target band between 2-3 percent (horizontal dotted lines). Click expand.

Georgescu has called for an end to the war, questioned financial support for Ukraine and is against Romania’s NATO membership.

The street is looking for Australian CPI to come in at 2.3pc year-on-year when its released tomorrow.

Most are calling for the detail to confirm more cooling, and still puts a rate cut on the table, albeit not until the Feb meeting.

If the pre report guess is right, it would put core inflation back inside the RBA target band of 2-3pc

Australia

In the west, canola bids were off around A$5 to be $805, with now a $100 spread to GM. Cereal bids were unchanged to end the week.

Canola bids were a touch softer in Victoria yesterday, being bid around $750. Wheat was slightly firmer, around $350, with barley bids steady at $315.

Lentil demand seems to be increasing with the recent rainfall through Victoria, and more forecast for the next week is likely to influence quality. Bids are currently around $880 port, with some up-country delivered homes bid around the same level.

Delivered Darling Downs markets are trading around $320 for barley and $338 for wheat.

HAVE YOUR SAY