Six per cent firmer corn prices led all markets to gain ground.

- Chicago wheat July contract up US27.75c/bu to 676.25c;

- Kansas wheat July contract up 27.5c/bu to 626.25c;

- Minneapolis wheat July contract up 36.5c/bu to 717.25c;

- MATIF wheat September contract up €6/t to €212/t;

- Corn July contract up 40c/bu to 664.5c;

- Soybeans July contract up 33.5c/bu to 1537c;

- Winnipeg canola July contract up C$24.40/t to $886.70;

- MATIF rapeseed August contract up €18.75/t to €520.25/t;

- US dollar index down 0.1 to 90;

- AUD firmer at US$0.774;

- CAD firmer at $1.208;

- EUR firmer at $1.218;

- ASX wheat July contract up A$1/t to $300/t;

- ASX wheat January 2022 down $2.30/t to $303/t.

International

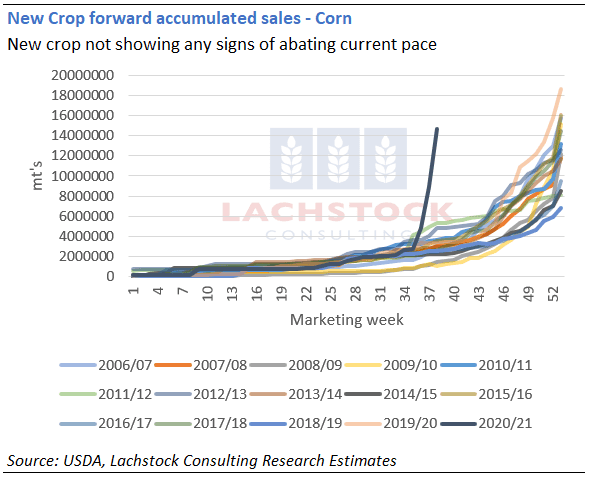

The China corn head fake. Reports of cancellations circled the market which, when you have one buyer, grabs your attention. This forces the market to assess risk premium and consider the “what if” – what if the reports of ASF increasing in the north of China lead to demand erosion? What if we spend the next month exiting high priced sales and return to more normalized sales pace? But wait… export sales came out with 5.7 million tonnes of new crop sales added over the week and it was game back on. As you can see from the chart attached of accumulated new crop sales, the pace is nothing short of extraordinary.

Market sentiment is a funny thing – yesterday you would have been lucky to find a story about Brazil corn despite the fact Dr Cordonnier cut another 1Mt off his estimate – yet today, post the rally the Brazil debate reignited.

The Argy port strike came to a quick end with port workers being given priority to get their COVID vaccine.

The break has unearthed a raft of demand although it appears little has been physically booked.

In the bucket of things to talk about when the market rallies, China corn rainfall has been lagging in parts of the growing belt. The northern crop is in the ground and mid-season (harvest Aug/Sep/Oct) and is running around 60-70pc of normal rainfall. The southern belt is in better shape, but harvest commences in the next month.

Australia

Old crop bids finished the day slightly softer but seemingly limited liquidity as growers happy to sit aside following the recent $10/t pull back off the highs.

Freight availability is seemingly loosening into the winter months as growers can put more wheels on the road.

Patches of SNSW that have seen patchy germination in canola have a 2-week window to re-sow. Limited areas at this stage, but yield penalties already apply to late sown crops.

More rain on the way for WA with 60-70 mm forecast for the majority of the belt.

Source: Lachstock Consulting

HAVE YOUR SAY