The day ahead

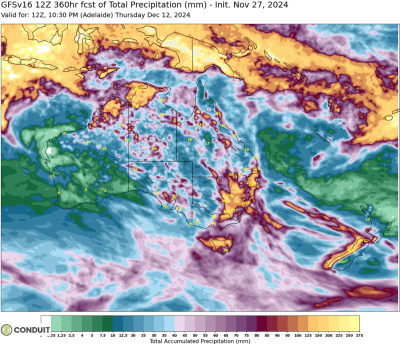

GFS modelling forecasts regional rain significant totals in the 15-day period to 12 December in parts of eastern Australia. Click expand.

Weather – If you are in the winter crop belt in NSW, you are going to get wet – no escape it would seem.

Fri and Sat look to be the eye of the storm with up to 120mm forecast in some models. Some moisture in the Black Sea, more rain for the UK, Germany and France, Argy corn areas also seeing rainfall. outside of that, nothing market moving. It’s all about Australia.

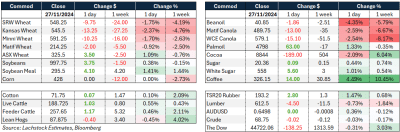

Markets – Ag risk off. Wheat and veg oil all found selling overnight with beanoil leading the charge. Swings and roundabouts. The beanoil strength yesterday, built around Trump slapping tariffs on Canada and China, disappeared as the trade considered that the logical way to deal with the inflationary nature of the tariff would be to cut the RFS. So much conjecture. Nothing is certain until Jan, and even then, no one knows. Physical wheat markets were actually quoted unchanged to slightly higher yesterday.

Markets – Ag risk off. Wheat and veg oil all found selling overnight with beanoil leading the charge. Swings and roundabouts. The beanoil strength yesterday, built around Trump slapping tariffs on Canada and China, disappeared as the trade considered that the logical way to deal with the inflationary nature of the tariff would be to cut the RFS. So much conjecture. Nothing is certain until Jan, and even then, no one knows. Physical wheat markets were actually quoted unchanged to slightly higher yesterday.

Australian day ahead – Defensive. Canola should be lower but, whatever remains to be harvested would be challenging at best. Additionally, front end shipments need to be filled and grower access would have a question mark over it if the BOM is to be believed. Wheat bids will be lower but I expect, if growers are sitting on APW and above, they will want to see what happens with this rain event.

Offshore

Buy the rumour, sell the fact, eat turkey, watch football. US markets will be closed, observing the Thanksgiving Holiday – the best holiday on the calendar imo.

The implications of increased tariffs are potentially skewed by changes that could happen to the bio-mandates in the US. Reports of refiners facing negative margins pushes the discussion back to the US balance sheet which, today, looks heavy. There are certainly two different discussions going on, ethanol and bio-diesel. Ethanol production last week set a record high according to the EIA.

Meanwhile, China continues to pick up US beans, one state buyer picking up 8 cargoes last week according to Bloomberg.

EU soft wheat exports for the season beginning July 1 totalled 9.2Mt vs 13.1Mt the same period last year.

Israel and Lebanon look to be advancing on a ceasefire, pushing the USD lower as the safety trade is unwound.

The Biden administration is asking for $24 billion in emergency funding for Ukraine. The Donald Trump pick for the special envoy for Ukraine and Russia, Keith Kellogg (remember that name, we will hear it a lot) wants to completely pull the plug on the funding for Ukraine.

Australia

WA canola bids were sitting just above A$800, with a $100 spread to GM. A significant 1Mt wheat line-up number for WA for December is causing some elevated bids in Kwinana and Geraldton port zones for wheat APW and AH grades where about $10-20 premiums can be achieved for prompt transfer.

The theme of divergence between the GFS model and the European model continues. In Victoria the range this weekend between the two models is from 0mm to 35mm.

With the US markets closed for Thanksgiving and a rainfall event covering the east coast we expect the market to be somewhat defensive today.

HAVE YOUR SAY