US markets were closed overnight. Canola/rapeseed markets firmed. The ASX eastern wheat January contract eased 1 percent.

The day ahead

Weather – Nothing of note for global weather with the exception of Australia. Rainfall models show no signs of softening with winter cropping regions apart from Western Australia forecast to receive at least 25mm in the next week with 50mm-100mm forecast for Vic and NSW.

Markets – some underlying support seen overnight for both Winnipeg canola and Matif rapeseed amid ideas that the recent losses were overdone. US markets were closed for Thanksgiving Day and will only open for reduced hours on Friday.

Markets – some underlying support seen overnight for both Winnipeg canola and Matif rapeseed amid ideas that the recent losses were overdone. US markets were closed for Thanksgiving Day and will only open for reduced hours on Friday.

Australian day ahead – Canola should be bid higher today on the back of a positive move in Matif canola. Wheat and barley bids are likely to be unchanged on the back of closed markets in the US with Thanksgiving Day holiday. Wheat grade spreads will be a watch for growers and traders alike as the extent of the rainfall damage becomes known.

Offshore

StatsCan is expected to raise its 2024 barley estimate to around 8Mt, up from 7.6Mt in September, consistent with a decade-long trend of upward revisions. While notable, this modest increase is unlikely to weigh heavily on the market, given larger factors at play.

Early forecasts put Russia’s 2025 wheat crop at just under 82Mt, slightly above the USDA’s 2024 estimate of 81.5Mt. With a smaller carry-in, this would make 2025/26 wheat supplies the tightest since 2021/22.

Russia mounted overnight its second large scale attack on Ukrainian energy infrastructure this month. Energy and fuel facilities were damaged across nine regions, and over 1 million people lost power in the immediate aftermath of the strikes. Russia used 91 missiles and 97 drones in the Thursday attacks. Ukraine’s air force reported 12 of those had hit their targets.

Tunisia’s state grain importer purchased 100kt milling wheat and 100kt durum wheat, both for shipment across the Dec/Jan window. Bangladesh bought 50kt wheat, price was expected to be around US$285/t cnf. Algeria’s state grains agency was also reported to have purchased close to 150kt milling wheat via tender.

Australia

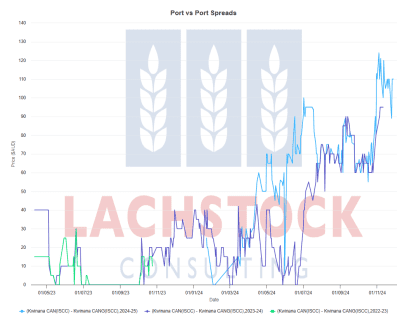

Three years chart of Kwinana canola gm and non-gm price spread. Genetically modified discounts are greater this year (light blue line) than last year (dark blue line). Early in the season it was less than A$30/t, now about $115/t. Click expand.

WA canola was softer yesterday, being bid slightly below A$800, with the spread to GM now around $115. WA wheat bids were firmer yesterday, around $380 FIS, with barley bids up $2 to $330.

In the east of the country, canola bids were off around $15, with bids around $742, down $50 from the same time last week. Barley bids were a touch firmer, around $314, with wheat bids around $340.

There is some strong prompt demand delivered to up-country homes for barley in the east, as rain brings harvest to a standstill, with around a $20 premium to local site prices.

Faba bean bids remain strong in the east, with Jan+ delivered Geelong/Melbourne bids around $680.

HAVE YOUR SAY