Markets continued to ease. Brent crude dropped 6 percent.

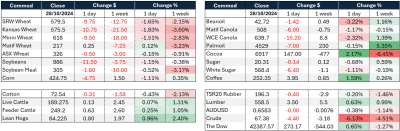

- Chicago December 2024 wheat down US10.25c/bu to 558.75c/bu;

- Kansas Dec 2024 wheat down 10.5c/bu to 561.5c/bu;

- Minneapolis Dec 2024 wheat down 10c/bu to 595.25c/bu;

- MATIF wheat Dec 2024 up €0.25/t to €217/t;

- Corn Dec 2024 down 4.5c/bu to 410.75c/bu;

- Soybeans Nov 2024 down 13.75c/bu to 974c/bu;

- Winnipeg canola Nov 2024 down C$14.90/t to $626.50/t;

- MATIF rapeseed Nov 2024 down €5.75/t to €502.50/t;

- ASX Jan 2025 wheat down A$0.50/t to $326/t;

- ASX Jan 2025 barley down A$1.50/t to $280/t;

- AUD dollar down 21 points to US$0.6583.

The day ahead

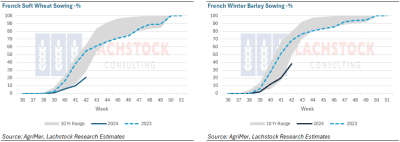

Weather – Better across the board. Rains continue to build in the US with parts of Oklahoma set to get 4-8 inches in the next 5 days. These rains will hit some of the driest parts of the belt – much of Oklahoma is sitting at around 10.5pc moisture in the 0-10cm layer vs the 10-yr avg of 21.4pc. Brazil is also looking better which will help both row crops and soft wheat. France still has 10 clear days to get moving on planting.

Markets – Down day. Not much was spared last night with grains and vegoil all lower. Crude was the biggie however, dropping over US$4/bbl. Risk premium was swiftly removed after Israel attacked Iranian military targets but strategically refrained from hitting energy locations. This one has some more twists and turns, for sure.

Australian day ahead – The AUD remains the main supporting factor in the Aussie market at the moment. MacBank’s call that the AUD would be lower under a Trump presidency was interesting. That outcome is something with which the bookmakers are getting more comfortable. A Bloomberg poll had US equities higher under Trump; 38pc to 13pc. Harvest pressure is largely still in front of us for wheat on Australia’s east coast and the exporters are busily waiting. Expect canola to be largely unchanged and cereals softer.

Offshore

USDA released its crop update. It reported 82pc of the soybean crop in the bin vs 78pc on average. Corn 68pc done vs 65pc last week and 64pc average while winter wheat was 82pc planted vs 84pc average.

In respect of crop condition USDA rated 38pc of the US winter wheat crop good to excellent vs the long-term average of 47pc. Today’s rating would be the second worst on record (28pc two years ago). This report was published after the close.

Crude was the driver it seems – the bombing didn’t hit energy targets seems to be an odd reason to sell off. Additionally, the fact Iran didn’t send a bunch of return fire was also noted. Fundamentally, you could argue that, at this stage, OPEC is set to return to normalised production levels in 2025 post a period of production cuts.

Both the EU and Stratégie Grain cut the EU sunflower crop predictions after excessive moisture was received, mainly in France. Sunflower competes directly with canola for crush capacity.

According to Brazilian agricultural consultancy AgRural, Brazil soybean planting for 2024/25 had reached 18pc, up 8pc for the week but still below last year’s 30pc.

Australia

Strong canola bids continued for Western Australia with conventional bid A$852 and GM $770. Wheat started the week largely unchanged bid around $365 and barley $317.

In the east of Australia canola was bid $790 with the spread to GM still around $50. Wheat was bid $346 and barley $300.

Chickpea bids have found some support at around $850 delivered Brisbane over the last couple of days, having come off close to $150 in the last two weeks.

The coming week looks to be largely a dry one for most of Australia’s cropping regions apart from regions along the east coast and parts of Qld. This will see harvest pace begin to pick up with harvest well underway in all states now.

I find it hard to get comfortable with a lower AUD – clearly a solid round of US data has slowed ideas that US rates go to zero, however, based purely on forward rate curves, Australia is set to be the slowest to move when compared to similar western economies. China remains the key and, for the AUD to rally, signs are needed that the measures taken by Beijing are spurring growth.

HAVE YOUR SAY