The day ahead

Weather – Rain, heaps of it. its all about Australia right now with the next pattern rolling across. Globally there is nothing market moving – but the world is watching Australia.

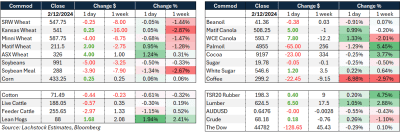

Markets – Back on the tools. US markets came back after a long weekend full of turkey and football. Wheat was lower in our session but managed to find some buyers. Vegoil also worked its way higher while the AUD and the Dow were lower on the day.

Markets – Back on the tools. US markets came back after a long weekend full of turkey and football. Wheat was lower in our session but managed to find some buyers. Vegoil also worked its way higher while the AUD and the Dow were lower on the day.

Australian day ahead – Segs a plenty. Bulk handlers are scrambling to create segregation that will allow growers to keep the hammer down before the next rain event. 14 percent moisture and shot and sprung segs are the first cab off the rank but the interesting part will be what happens to grade spreads. With NSW only having 20pc to go, it will be the markets job to decide if there is enough APW1 and above to satisfy both domestic and export demand.

Offshore

France is a political dumpster fire. Le Pen’s National Rally party is set to join a left-wing coalition to topple the govt as soon as this week.

Wheat futures markets grabbed hold of an article that quoted a Kremlin confidant saying that Moscow was likely to turn down a Ukraine cease fire brokered by Donald Trump.

According to the Bolsa de Cereales, the Argy wheat harvest is 38.7pc done. Soybeans are 44.4pc planted, corn is 41.3pc planted.

ANZ bank has shifted its stance on RBA’s policy. They are now looking for a later, shallower easing cycle, pushing the first cut from Feb to May 2025 and have lowered to 2 x 25bp cuts vs their previous idea of 3 x 25bp cuts.

Australia

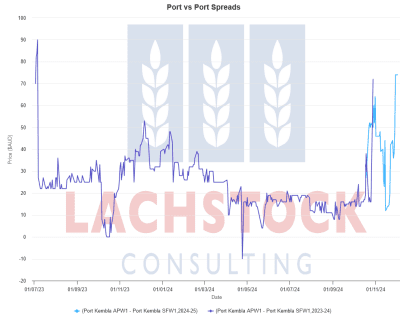

Stockfeed wheat to milling wheat price spreads. Current crop (light blue) and old crop (dark blue). Click expand.

Canola prices in the west were largely unchanged to start the week, with bids around A$812 FIS for most PZs. Wheat bids were off slightly to start the week, down $5 to be bid at $375, with barley off around the same, bid at $325.

In the east of Australia, canola bids were up a little, bid around $760. Wheat bids were slightly stronger, with APW bids around $350, while barley was largely unchanged.

Feed wheat is the hot topic throughout Vic, SNSW, and parts of SA with recent falls and forecasted falls to come. The price spread between APW and SFW has widened in recent days, pricing in the widespread quality downgrades. If there’s a silver lining to this, it’s that it should work nicely into China and might turn on some demand.

Lentil prices are around $915 in PAD, up around $60 over the last two weeks. This is likely due to increased export activity, with 120kmt on the stem for December out of SA, coupled with the latest ABARES December estimate of a 535kmt lentil crop in SA, down 31pc on last year.

HAVE YOUR SAY