Weather: I am not sure this section is needed – the market doesn’t care about weather.

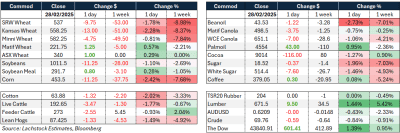

Markets: More red. At one point it looked like Donald and Zelenskyy were going to throw hands. There is so much outside market noise, fundamentals are still in the back seat. Much has been communicated about the “what if’s” from a supply side but the demand just doesn’t have a sense of urgency at all – hence, markets bleed.

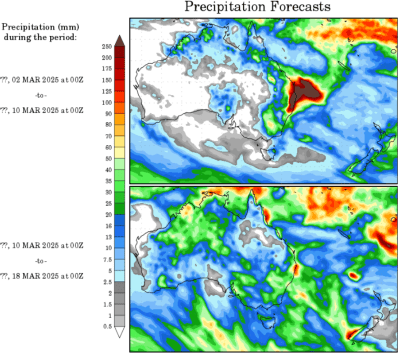

Australian Day ahead: The AUD is the saving grace yet again – Since mid last month, Chicago wheat has lost just over 9 percent – in AUD terms the move has been just over 6%. Meanwhile, Russian cash is just under 1% higher over the same period. Aussie markets are all about weather – in the north it will be interesting to see if cyclone Alfred can get some rain further inland. In the south, the back end of the forecast looks encouraging.

Cyclone Alfred is set to dump rain on coastal eastern Australia in the week ahead. Source: National Centres for Environmental Prediction via Lachstock.

Offshore

- Russian export projections lowered: Continued reduction in Russian export projections and production risks may tighten global wheat supply.

- US business activity in wheat: Reports of some US wheat sales and donation business in HRW provided brief market support.

- Southern Plains needing rain: Dry conditions in key US wheat-producing regions could impact crop yields.

- India’s heatwave risk: Hotter-than-usual temperatures could damage wheat crops, potentially leading to lower production and higher global wheat prices.

- Brazil considering ethanol import tax cut: Brazil’s potential move to lower import taxes on corn-based ethanol may support US corn demand.

- China pledging to prevent price fluctuations: Beijing’s focus on stabilising grain prices may suggest buying interest or strategic stockpiling.

- Final insurance numbers for new crop outlook: Corn (CZ) insurance price is slightly above last year, and soybean (SX) price may incentivise planting, impacting supply outlook.

- France’s wheat conditions still poor: While better than last year, the wheat crop rating remains among the lowest in the past five years.

Bearish Factors

- Broad commodity sell-off: Grains, corn, and beans all faced significant declines, showing no signs of immediate support.

- Tariff uncertainties & trade tensions: US imposing 25% tariffs on Mexico and Canada, 10% additional tariffs on China – these are set to drop in Tuesday.

- China threatening countermeasures, worsening US-China trade relations.

- Increased tensions between the US and Ukraine.

- Large deliveries in wheat markets: Chicago (466), KC (314), and Minny (589) deliveries suggest weak demand and ample supplies.

- Corn and bean markets failing to hold gains: Corn dropped back to levels seen during the January WASDE, with significant open interest (OI) declines indicating traders exiting positions.

- Ukraine grain exports steady, but February lower: While total exports are down only 1% YoY, February shipments were 40% lower, potentially signaling weaker international demand.

- Brazilian soybean harvest pressuring prices: Brazilian harvest progress continues to weigh on global supply, limiting upside in soybean markets.

- US agricultural trade deficit: Expected to hit $49 billion due to record food imports, signaling demand issues for US ag exports.

- EPA lawsuit dismissal request: The EPA is seeking to dismiss a lawsuit against it by biofuels groups, potentially impacting biofuel policy outlook.

- The overall tone is bearish, with market momentum accelerating downward due to trade uncertainty, broad selling pressure, and weak technical indicators. While some supply-side risks (Russia, India, and US weather conditions) exist, they have not yet translated into a shift in sentiment. The near-term outlook remains cautious, with traders hesitant to step in amid ongoing tariff threats and geopolitical tensions.

Australia

Groundhog day – the Aussie market maintained the theme over the week with new crop markets leaking lower in cereals, while canola found more bids. Old crop markets are still well supported and it will be interesting to see what a wide spread 1 inch would do to value (not guaranteeing it!)

Donald Trump’s trade adviser, Peter Navarro, has alleged that Australia is exporting subsidised aluminium to the United States at below-market prices, likening its actions to those of Russia and China. His remarks come amid growing concerns that the Albanese government may not secure an exemption from tariffs. This follows Treasurer Jim Chalmers’ recent visit to Washington, where he lobbied for Australia to be excluded from the 25 percent tariffs on steel and aluminium. However, Navarro, a strong advocate of protectionist policies aimed at strengthening American manufacturing, stated that ending country-specific exemptions “sends a clear message”.

HAVE YOUR SAY