The day ahead

The day ahead

Weather – The US has had a wild ride this year. Snow on Florida beaches, winter fires in California, and history-making rainfall through the HRW in November. Not that it matters given snow cover but it has not really rained since and temps have been record low and record high through that period. We are getting close to talking about the dormancy break which, for the entire northern hemisphere, feels like it will be messy.

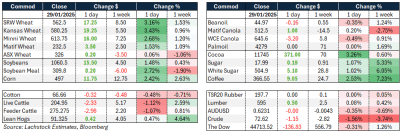

Markets – Rally Wednesday? Wheat continued its march higher mainly on news by the Russian Grain Union that wheat exports could be as low as 41 to 42 million tonnes (Mt) (USDA 46Mt). I was impressed the AUD held in there overnight given Fed Reserve Chair Powell’s comments that he is in no hurry to cut.

Markets – Rally Wednesday? Wheat continued its march higher mainly on news by the Russian Grain Union that wheat exports could be as low as 41 to 42 million tonnes (Mt) (USDA 46Mt). I was impressed the AUD held in there overnight given Fed Reserve Chair Powell’s comments that he is in no hurry to cut.

Australian day ahead – Similar theme to yesterday with offshore really just supporting values. Given that US futures rallied on Russian news, it will be interesting to see if that helps the bid. Ocean freight will be free soon – always wanted to hire a panamax for a day and see if we can hit a 1 wood the length.

The Australian dollar eased only a little against the US, despite comments bullish to the US dollar made by the US Federal Reserve chair. Source: Bloomberg via Lachstock. Click expand

Offshore

Russian wheat exports have long held the key for global values, yet it needs the demand side of the market to show some urgency. The list of supportive factors includes implementation of export quotas, Russian new crop conditions going into dormancy at 37 percent less-than-good condition versus the average of 15-20pc, and now, a reduction of exports to 41-42Mt.

Russia expects to export 57Mt total grains in 2024-2025, a decrease from the record 72Mt shipped last season, according to Russian Agriculture Minister Oksana Lut. With grain exports reaching 37Mt in the first half of the year, Moscow has tightened quotas for the remainder of the season to prioritise domestic demand.

The spec positioning in Chicago wheat is still short, a safe bet for the last few months but becomes more tenuous closer to dormancy break.

Hot and dry conditions have begun to affect Argentine crops, with soybean crop ratings falling for six straight weeks with further falls likely. Analysts now predict a 49Mt crop with a neutral to lower basis, previously low to mid 50s.

Although India’s monsoon starts in June, the next two months are crucial for wheat yield and quality. Off-season storms with heavy rain could reduce milling wheat supply, possibly making India an importer in late 2025.

Australia

Western Australian canola bids were down around $5-$10 yesterday, bid $835. The GM spread tightened on the back of Canadian futures rising with GM bids around $750. Wheat bids were firmer around $371 and barley $332.

The eastern Australian GM canola spread reduced from around $120 discount to $100. GM was bid around $650. Wheat was steady with APW $342 and barley unchanged.

New crop pricing is starting to become available. Eastern canola track bids are around $730, and APW $336. Western Australian new crop bids are $795 canola and $385 APW.

Weather models for southern Australia are split between wetter or neutral rainfall for next 3 months. Above average temperatures are forecast. A good autumn break would be welcome through SA and Vic as livestock feeding is now beginning in earnest.

HAVE YOUR SAY