Canola eased, rapeseed and soybeans gained. US wheat gained a little. Brent crude gained 2 percent.

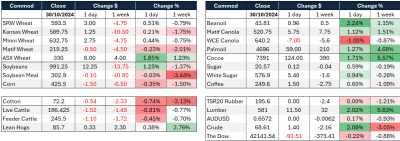

- Chicago December 2024 wheat up US2.75c/bu to 573.25c/bu;

- Kansas Dec 2024 wheat up 1.5c/bu to 575.75c/bu;

- Minneapolis Dec 2024 wheat up 2.5c/bu to 609c/bu;

- MATIF wheat Dec 2024 down €0.50/t to €219.25/t;

- Corn Dec 2024 down 2.25c/bu to 411.5c/bu;

- Soybeans Nov 2024 up 11.25c/bu to 976.5c/bu;

- Winnipeg canola Nov 2024 down C$7.40/t to $624.40/t;

- MATIF rapeseed Nov 2024 up €4.75/t to €514/t;

- ASX Jan 2025 wheat up A$6/t to $330/t;

- ASX Jan 2025 barley up A$1/t to $276.50/t;

- AUD dollar up 13 points to US$0.6574.

The day ahead

Weather – Rains starting in the US with a pattern currently running through northern KS, southern NE into IA. Brazil weather perfect for them to catch up on planting. EU (mainly France) also looking clear, Russian topsoil moisture has largely improved through the last half of Oct. Basically nothing threatening on the weather front.

Markets – Fresh contract highs for Matif canola overnight, now up EUR$74/mt since mid Aug. Wheat started the day in the red, mainly driven by selling in Matif – then we found a bid. Every tender is significant but, given the price action over the last few days, the Algerian tender seems to be pretty important. US GDP was slightly below expectations but ADP employment was better, as was personal consumption.

Australian day ahead – Demand? balanced from an offshore market perspective – AUD basically unchanged and futures the same so its all about what the local market thinks about demand. Headers rolling should keep the market balanced but, the conflict between Russian cash bleeding lower vs their ridiculous export pace makes Jan forward export parity calculations messy at best. Canola shouldn’t let up.

Offshore

The U.S. economy grew at a strong rate in the third quarter, driven by increased household spending and higher federal defence expenditures. Hiring surged to its highest level in over a year, sparking claims that the elusive “soft landing” may have been achieved. According to preliminary government estimates released Wednesday, inflation-adjusted GDP rose at an annual rate of 2.8pc, following a 3pc increase in the previous quarter. Consumer spending, the main driver of economic activity, climbed 3.7pc—the highest since early 2023—supported by broad-based gains across goods like automobiles, home furnishings, and recreational items. Meanwhile, a key measure of core inflation increased 2.2pc, aligning closely with the Federal Reserve’s target.

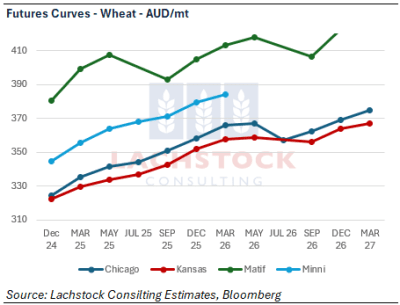

Wheat markets are messy. Massive export pace out of Russia is in every wire, but so is the slide in Russian FOB value. Adding to the mess is Black Sea market analyst SovEcon cutting its forecast for 2024/25 wheat exports from 47.6Mt to 45.9Mt. The dry start starting to have some impact. Matif makes things even more confusing with massive carries but tight stocks. One tender can change market sentiment, so all eyes are on Algeria. Jordan also sniffing.

Wheat markets can’t ignore corn – even with a big US crop, global balances are snug. Even more so after the USDA attaché to the Ukraine took a knife to the Ukraine export program. US export sales have been impressive with more printed yesterday. While the big chunk to Mexico could be regarded as “routine” the fact it was in the front end of the marketing window is significant.

The US election is within sight – some potentially big impacts to Australian agriculture. Currency, potential for an increase in tariffs between the US and China along with possible amendments to the biofuel mandates in the US. Interesting that the USDA Dep Sec threw another $239M in grants to the US domestic biofuel industry. Trump is still favourite but drifted out a little yesterday with the book makers – worth noting they haven’t been a good predictor of the US election.

Australia

Canola bids made up for a Tuesday’s losses with some more positive movement in bids, conventional was bid A$850 and GM $770 FIS, up around $10.

Wheat also saw bids rise between $3-$8 being bid $370 FIS in most WA PZs.

In the east of Australia canola was also well supported with bids up $6-$12 to be bid $800 for conventional and $747 for GM. Cereal bids were largely unchanged.

Faba beans continue to see strong exporter demand with bids around $550 into Geel/Melb/PAD.

Harvest deliveries in NSW might prove more frustrating starting Tuesday with the AWU members voting to begin one-hour stoppages at GrainCorp sites in New South Wales, following a failed conciliation meeting with the Fair Work Commission.

HAVE YOUR SAY