The day ahead

Weather – Copy Paste. All about Australia with more front end rain building in northern NSW and Qld. It does seem that the more extreme forecasts for Vic and southern NSW are being pegged back a little – still rain however. Northern hemisphere is sliding into winter with less importance on what happens for the next few months.

Markets – Don’t call it a comeback. Vegoil continues to find support – across all classes. Palm is once again leading the charge, holding a massive premium to soyoil – the shift from both Malaysia and Indo to B40 is certainly a tightening mandate.

Markets – Don’t call it a comeback. Vegoil continues to find support – across all classes. Palm is once again leading the charge, holding a massive premium to soyoil – the shift from both Malaysia and Indo to B40 is certainly a tightening mandate.

Australian day ahead – Will this rain event push from milling to good quality SFW/AGP1 or will this be a wide spread feed event. The next round of rainfall will be the determining factor in some areas. China wheat demand is a crucial factor in our balance sheet and the fact Argentina is on the verge of pushing wheat into China adds uncertainty. Does a wide spread feed event get China interested, and how far under Argy would that be?

Offshore

Global tightness in wheat has long been talked about. The frenetic export pace from the Black Sea has a use by date with the announcement of quotas that, if nothing else, slow supply.

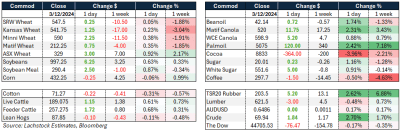

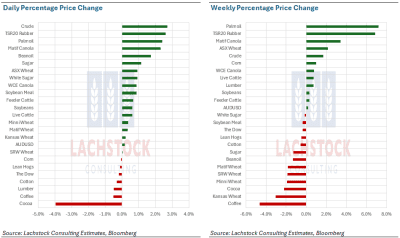

Overnight increases in the prices of oils and fats has boosted weekly gains. Palmoil is up 7 percent this week. Click expand.

Seasonally, winter creates its own tightening so the reality of the Feb-Jun quotas may hit earlier. France is historically seen as the next cab off the rank but, both quality and quantity are questionable. So then it’s up to Australia and Argentina to get busy. Argy is always priced to sell and recent talk that they will push wheat into China for the first time in decades takes some sting out of the panic.

US soybean crush had a seasonally massive print, 215.8mbu in Oct, up from 186.5mbu in Sept. Interestingly, soybean oil stocks shrank with solid exports being driven by soyoil’s discount to palmoil.

The Commonwealth Bank of Australia (CBA) has revised its forecasts for the Australian dollar (AUD) in light of anticipated US trade policies under President-elect Donald Trump. CBA now predicts that the US dollar index (DXY) could reach 110 by September 2025, a level not seen since November 2022. This projection is based on expectations of heightened tariffs and a potential trade war, which would likely strengthen the US dollar. Consequently, CBA has adjusted its AUD forecasts, now anticipating the currency to fall to US61¢ by September 2025—a 14pc downgrade from previous estimates. Earlier, CBA had projected the AUD to rally to US70¢ by June 2025, but this target has been deferred to the end of 2026. These revisions reflect concerns that US trade policies could lead to a stronger US dollar, thereby exerting downward pressure on the Australian dollar. Such currency movements can have significant implications for Australia’s export competitiveness and overall economic health.

Australia

In the west of the country, canola bids were firmer yesterday, being bid around A$825, with GM canola still at a discount of $105. Wheat bids were slightly firmer, bid at $380, with barley at $325.

Eastern Australian canola bids were stronger, up $7 to $777, with the spread to GM now at $120. Wheat bids were firmer for APW and better, with H2 bids around $365 and barley at $310.

Lentil bids remain strong, with prompt delivered Melbourne trading at $940 yesterday.

Delivered Darling Downs markets are being bid around $319 for barley and $338 for wheat for Jan+.

Chickpea production for 2024/25 has increased in the December ABARES report, with NSW production now pegged at 1.1Mt and Qld at 750kt. Bulk chickpea exports now account for 45pc of the crop already committed for export.

HAVE YOUR SAY