Weather: Some big intra day temp swings occurred around the northern hemisphere growing regions. North Dakota went from -7.2c to +6c in 24 hours. It has good snow cover. Russia got down to -12.6c and Germany was -4c. We are in the winterkill hitting zone but it is all about tariffs today.

Markets: Hands up for accountability – I was a firm believer that Donald would not go through with the Canadian tariffs. It looks like I was wrong. Markets are now simply trading an inflation-led super strong USD – which is bearish commodities. Lots of noise will be coming in the next 24 hours.

Australian Day ahead: Even with another kick in the dollar index, the AUD actually found some footing yesterday, albeit from a low base. With the exception of a very small sliver of the Great Australian Bight, there is rain for the entire country on the back end of the 15-day forecast. Expect markets to be a little defensive going into a combination of Donald and Alfred.

Offshore

President Donald Trump has reiterated his intent to impose tariffs on Canada and Mexico, after months of threats and delays. Markets reacted sharply, with the S&P 500 experiencing its worst selloff of the year. However, speculation remains about whether Trump will follow through, as an aide hinted that the 25 percent tariff rate might be adjusted. The broader US economy is already showing signs of strain, with fears of a trade war adding to concerns. Recent economic data has highlighted rising inflation and unemployment, and a private survey indicated that US factory activity is nearing stagnation, with new orders and employment contracting. Investor sentiment is shifting toward caution, with Callie Cox of Ritholtz Wealth Management advising a “nervous” but not entirely bearish outlook in response to the uncertainty.

- Short Market Positioning: Wheat markets are already short, which means a “risk-off” environment could trigger buying interest.

- Trade Disruptions & Supply Concerns: US wheat imports from Canada may stop due to potential tariffs, which could tighten domestic supplies. Mexico’s wheat imports from the US are largely transported by rail, making them somewhat insulated from trade disruptions. Russia’s wheat exports are struggling due to poor growing conditions, low profitability, and negative margins. Egypt needs more wheat as domestic prices rise, and a new €90M loan will help finance imports. India’s wheat import story is resurfacing, as local millers urge the government to remove the 40pc import tax, which could open up demand.

Bearish Factors

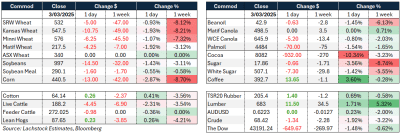

- Falling Prices Across Global Markets: US wheat futures dropped sharply (WK -8c, KWK -11c, MWK -6.5c), with Paris Matif March down €4.50 and Russian cash wheat prices falling $1 to $251. Wheat tried to rally overnight but quickly turned lower during the day session.

- Bearish Fundamental Developments: The Australian wheat crop estimate was revised higher to 34.1 million tonnes (Mt) up from 31.9Mt, adding more supply to the global market. Kansas HRW wheat conditions improved by 4pc, reducing immediate concerns over crop stress. Better moisture appeared on midday maps for the US HRW wheat belt, improving yield prospects. Egypt’s wheat purchases remain uncertain, despite higher domestic prices.

- Trade & Macroeconomic Uncertainty: Tariff threats from Trump could disrupt trade, especially with Mexico and Canada. The Euro rallied, making European wheat less competitive on export markets. Uncertainty regarding trade agreements continues to weigh on market sentiment.

Australia

Softer tone to markets to start the week with the downturn in offshore markets. Port Kembla canola trading $780 track while APW1 drifted to $340 on very limited volume.

Eyes are starting to turn towards the skies in the next two weeks with some potential for next week to be some sort of seasonal break.

Sorghum harvest version 1 is nearing its end with the early crop mostly off. The drawn out tail will take some time to roll in. Demand still strong from exporters with track values holding together $345-50 range.

RBA minutes from the Feb rate cut meeting will be pored over today.

HAVE YOUR SAY