The day ahead

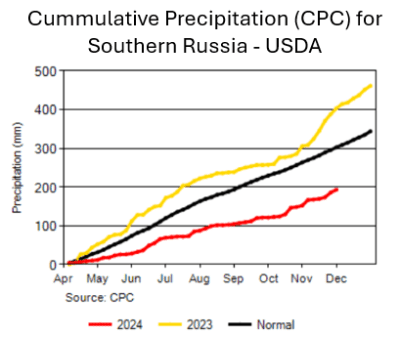

Southern Russia cumulative precipitation in 2024 (red line) is below normal and very much below 2023 (yellow line). US government Climate Predication Centre (CPC) data.

Weather – Australian rainfall forecasts have eased a little – still rain but not the extreme falls predicted yesterday. Markets still working out what this means re quality and quantity given the big difference between SFW1 and Feed.

South East Asia is set for some massive rainfall which is expected to slow palm production.

Another day, another disappointing forecast for Russia. Now comes the cold. Temps in the crucial southern growing region of Russia are set to fall 3-5°C below normal which will slow any potential growth.

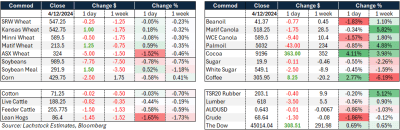

Markets – Mixed close last night as markets look for the next input. Veg oil took a breather but it is hard to imagine this is over just yet. Palm holds a massive premium to bean oil but this weather may push it even further. AUD has no mates.

Markets – Mixed close last night as markets look for the next input. Veg oil took a breather but it is hard to imagine this is over just yet. Palm holds a massive premium to bean oil but this weather may push it even further. AUD has no mates.

Australian day ahead – Rain backing off a little maybe the difference between Feed and SFW. The variability in quality is nothing short of amazing and holds the key for value. High pro, weather affected wheat has historically been very marketable into Asia… at a price.

Offshore

The Russian government does not release a crop condition rating as such, but a few private forecasters will have a crack. The latest is from analyst ProZerno which thinks the Russia wheat crop is 37pc not sprouted or rated as poor. The crop rated as “good” was 31pc vs 74pc last year, representing the lowest rating in 23 years.

The wheat market is like a slow-moving car crash, but still needs China to confirm the tightness. Talk of Argy wheat moving into China is not necessarily bearish. Yes, Argy is priced to clear, as it always is. But should China take Argy or Australia, the tightness in Q1 becomes a reality. US futures may not be the best barometer for the world wheat market, as we have seen this week with both Russian cash and Matif outperforming the US exchanges.

Thailand issued a tender to purchase 120,000t optional-origin feed wheat, and Jordan opened a tender to acquire up to 120,000t optional-origin milling wheat.

Federal Reserve Chair Jerome Powell said the US economy was in remarkably good shape, and noted the downside risks from the labour market had diminished. Speaking at the New York Times DealBook Summit in New York, he emphasised that Federal Reserve officials can take a cautious approach as they gradually lower interest rates toward a neutral level, one that neither stimulates nor restrains economic growth.

The primary pressure on CBOT grain futures continues to be favourable weather conditions in South America. Regions including Brazil are receiving sufficient rainfall to benefit the developing crops without causing major issues.

Australia

Canola bids in Western Australia continued to strengthen, with bids around A$852 and a $110 discount for GM varieties. Wheat bids were $5 stronger, around $385, with barley bids at $330.

In the east of the country, canola bids worked higher yesterday to around $780, with GM canola bids at $678. Wheat bids were largely unchanged, with APW around $350 and barley at $308.

Over the next week, 25-50mm of rainfall is forecast for most of the NSW cropping region, with 15-25mm expected across the entirety of SA and Vic.

Viterra receivals have now reached 2 million tonnes for South Australia, with half of this in the Western region. Wheat makes up half of the deliveries, followed by canola and then barley.

The second test under lights in the humid conditions starts tomorrow in Adelaide, with SA growers working around the clock to beat potential thunderstorms so they can watch Starc swing the pink ball around corners.

HAVE YOUR SAY