The day ahead

The day ahead

Weather – Depending on what is your preferred weather model we are in for some market-testing events in the next 2 weeks. According to the GFS model, Russian winter wheat areas will move from 2°C to minus 6°C. Conditions have been historically warm, particularly through January, snow cover is limited at best, so, if the GFS is correct, we need to watch winter kill.

Markets – Trump-a-tariff. The 25pc tariff on Canada has, along with Mexico, been delayed for one month. Ag markets generally liked the news but so did the AUD.

Australian day ahead – Hard to ignore the Trump fun and games but, given the heat on the east coast, feed markets remain firm. There is talk about the likely timing of the the seasonal break despite it only being in early Feb.

Offshore

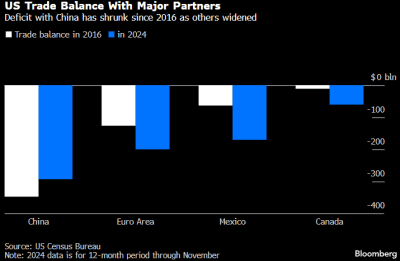

According to US Census Bureau data the US trade deficit with several major trading partners in 2024 (blue columns) was smaller with China than in 2016 (white columns) but had widened with several others including Europe, Mexico and Canada. Source: Bloomberg via Lachstock. Click expand

President Trump signed his executive order on Saturday imposing 25 percent tariffs on Canada (10pc on energy) and Mexico along with 10pc on Chinese imports. Then we had the “oh yeah, well, if you do that, we will do this” retaliation including Trudeau promising a package that would put 25pc tariffs on C$30 billion US imports with another $125b in the chamber. In the Canadian provinces, retaliation looked a little different with many of them ordering the removal of all American beer, wine and liquor from Canadian shelves. Today, things are finding some common ground. Canada has appointed a new fentanyl czar, listed cartels as terrorists and will create a new bilateral strike force, with the US, to fight organised crime.

Russian wheat exports in Feb are estimated to be 2.2-2.3 million tonnes according to Rusagrotrans, down 50pc over the same period last year.

Black Sea market analyst SovEcon indicated interior Russian wheat values were up 9pc since the beginning of 2025.

We have been focused on weather in SAM and Russia, but the HRW wheatbelt of the US has had wild temperature fluctuations, from January 21 at minus 18°C to a high of 25°C on February 4.

Australia

Western Australian canola bids yesterday were steady around A$805 for the current crop, and $800 new crop. Wheat bids were a touch softer, down around $2 to $371, with new crop bids around $389, while barley was back around the same to $340.

Through the east of the country, canola bids were steady around $760, with wheat at $345 and barley firmer around $330, closing the east-west spread on barley.

Forecasting models are predicting a neutral-to-wetter Feb-Apr period for Victoria, coupled with warmer temperatures, with most models suggesting rainfall will be neutral through the May-July period as well.

New crop track APW1 markets are trading at a premium to the current crop, with SA bid at $360, Vic at $362, and Port Kembla at $362.

Sorghum harvest continues to roll, with reports of big yields around 4–5t/ha. Sorghum bids continue to be well supported, with delivered Brisbane/Newcastle bids around $352 and Darling Downs bid at $322.

HAVE YOUR SAY